I hope you all had a fantastic Family Day long weekend, whether you spent it with family, friends, or just enjoying some well-deserved downtime!

While last month, much of the conversation was focused on the new mortgage rules and their impact on the housing market, this month, that discussion has been pushed aside for a far more pressing issue: Trump Tariffs—which will undoubtedly have a major impact on our market, no matter how you look at it.

Tariffs & Their Impact on Canadian Real Estate

The 25% tariff on Canadian imports, originally set to take effect immediately, has now been postponed until March. These tariffs will be imposed on a wide range of Canadian goods entering the U.S., including:

- 10% on Canadian energy – Thanks to Danielle Smith, who successfully negotiated this down.

- 100% on automobiles – A staggering increase that will send shockwaves through multiple industries.

- 25% on a variety of goods and products, including steel – Adding further cost pressures across key sectors.

What Does This Mean for Real Estate?

- Higher Consumer Prices → Inflationary Pressures

- With tariffs driving up costs, the Bank of Canada may announce emergency interest rate cuts—a move they’ve already hinted at twice.

- Construction Costs Stay High → Affordability Drops

- The cost of building homes isn’t getting any cheaper. If affordability declines, demand will likely continue to soften.

- Supply Chain Disruptions → Market Uncertainty

- Canada still relies heavily on U.S. imports. If supply chains are disrupted, construction materials, goods, and even employment sectors could take a hit.

Will The Tariffs Actually Happen?

There are three camps of thought on this issue:

Regardless of who you blame, the real impact is uncertainty. And in real estate:

And that’s exactly what we’re seeing as we look back on January and the first half of February.

If this whole thing gives you anxiety… same. Keep reading.

Speaking of anxiety check out my latest post on BMO’s new forecasting:

January Highlights

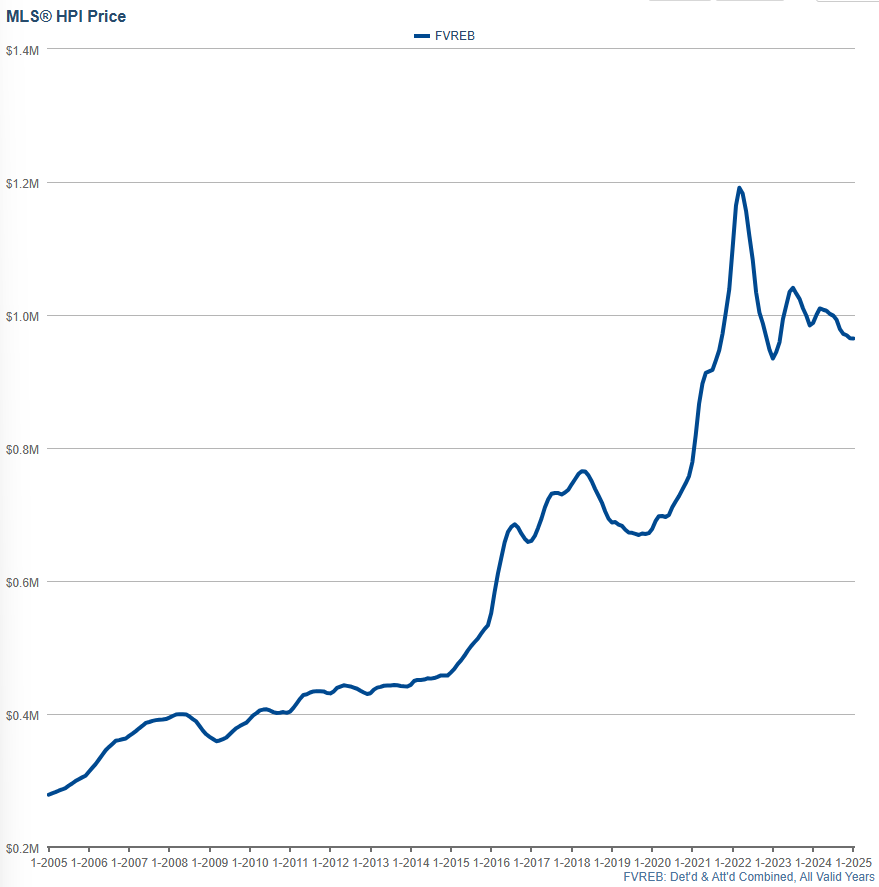

January marked the 10th consecutive month of decline in the Housing Price Index (HPI) for Detached and Attached properties, including Houses, Townhomes, Condos, Duplexes, and Row Homes in the Fraser Valley.

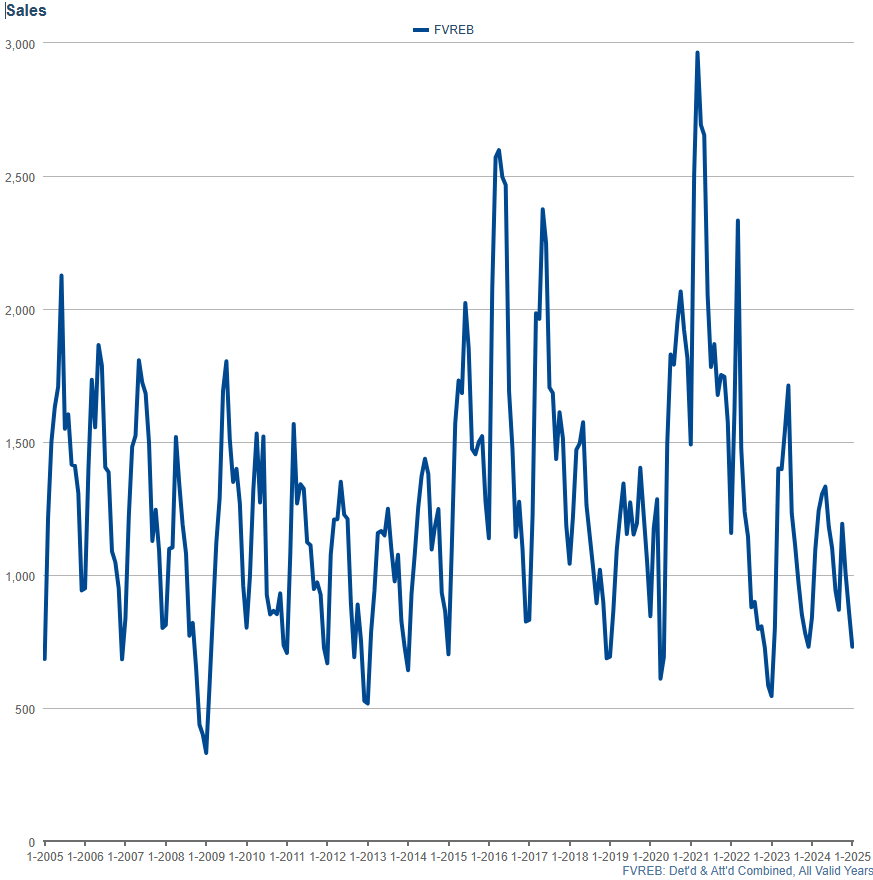

However, sales volume tells an interesting story—depending on how you look at it.

- December saw 864 sales, while January dropped to just 730 sales.

- That makes it either the 10th slowest or 10th fastest January on record, depending on which side of the data you focus on.

Key Stats for January

- HPI price fell slightly from $965,000 to $964,800 (combined Attached & Detached), marking a 0.02% month-over-month decline.

- Home prices remain the same as they were in October 2021, meaning we’ve now erased over three years of appreciation.

Price Change Recap:

- January 2025: -0.02%

- December 2024: -0.46%

- November 2024: -0.23%

- October 2024: -0.7%

- September 2024: -1.4%

- August 2024: -0.7%

- July 2024: -0.3%

- June 2024: -0.5%

- May 2024: -1.0%

- April 2024: -0.2%

(revised from +0.5%)

(revised from +0.5%) - March 2024: +1.4%

- February 2024: +0.9%

(previously recorded incorrectly as +3.7%)

(previously recorded incorrectly as +3.7%) - January 2024: -0.3%

- December 2023: -1.5%

- November 2023: -1.1%

- October 2023: -1.4%

Sales Volume

January continued the trend of slower market activity, with sales dropping from 864 in December to 730 in January, marking a 15.51% month-over-month decline.

While January is sometimes slower than December, it’s typically a busier month. However, given the current economic/trade war uncertainty, this slowdown isn’t entirely surprising.

For context, here’s how the last six months have compared historically:

- January 2024: 10th slowest/fastest January in 20 years

- December 2023: 9th fastest December in 20 years

- November 2023: 9th slowest November in 20 years

- October 2023: 10th slowest October in 20 years

- September 2023: 5th slowest September in 19 years

- August 2023: 4th slowest August in 20 years

- July 2023: 3rd slowest July in 20 years

While this isn’t necessarily a step in the right direction, it’s also not a sign of an outright crash—it’s just the reality of an uncertain market. We’ll continue tracking these trends in the months ahead.

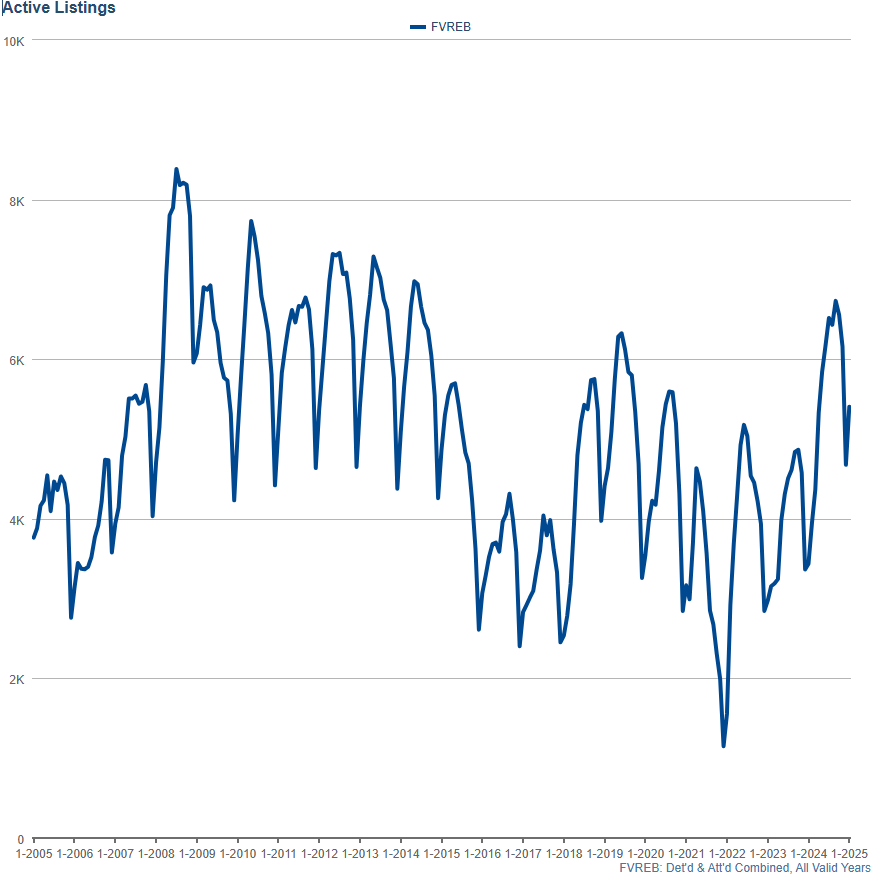

Active Listings

Inventory climbed in January, with active listings rising from 4,658 in December to 5,405—a notable increase after the seasonal slowdown.

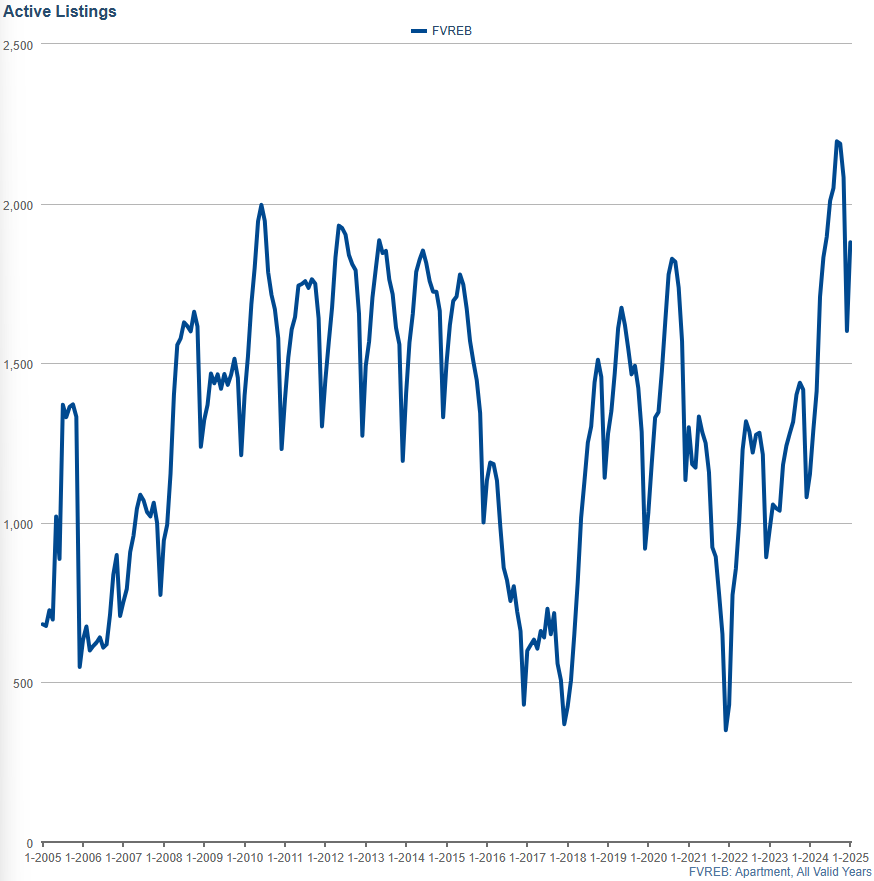

For condos specifically, inventory saw an even bigger spike:

- 1,879 active condo listings in January

- 7th highest month ever on record for condo inventory

- Highest number of condos ever listed in a January

Why Is Condo Inventory Surging?

A significant portion of these condos were purchased by investors who planned to rent them out for profit. But with:

- Sales volume down

- Valuations dropping 15-20%

- Negative cash flow piling up

- Interest rates still much higher than when these properties were bought (many as pre-construction units)

…many of these investors can’t afford to sell at market value, yet they’re also losing money every month.

This dynamic explains why the condo market is seeing a surge in listings—but not necessarily in sales. Until rates shift or valuations stabilize, this imbalance will likely continue.

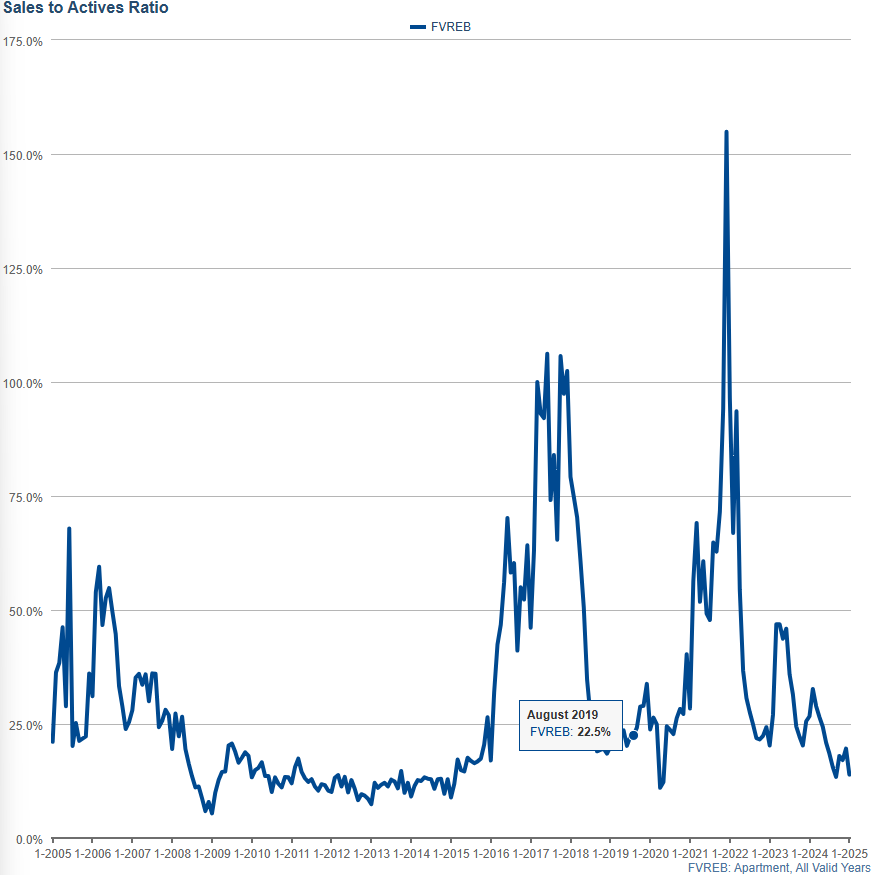

Sales Ratios

Sales ratios (the percentage of active listings that sell in any given area) increased from 16.4% in NSales ratios—a key measure of market activity—declined in January, reflecting softer demand across most property types.

- Overall sales ratio fell from 18.5% in December to 13.5% in January

- Condo sales ratio dropped from 19.6% in December to 13.9% in January

This decline suggests a cooling market, where a smaller percentage of active listings are actually selling.

What This Means

- Condos continue to struggle with demand slowing across multiple areas.

- Lower to mid-price ranges still see more movement, while the luxury segment remains sluggish.

- Buyers have more options, sellers face more competition, and pricing strategy is more critical than ever.

Sales ratios provide a real-time pulse on market conditions, and January’s drop reflects the uncertainty buyers are feeling heading into 2024.

My Forecasting

Canada’s Economy Is in Trouble—But There’s Hope on the Horizon

In the short term, things are going to be tough.

We’re about to watch the Liberal government bungle critical trade negotiations with Trump, failing to make any meaningful progress while Canada faces crippling tariffs on energy, automobiles, and key industries.

And where is Trudeau?

Instead of traveling with all 13 premiers to Washington to advocate for Canada, he was strutting around an AI conference in a tight pink suit, lecturing about how we can’t let AI spread misinformation—spoken like the true king of misinformation himself.

Meanwhile, back in reality, Canada just posted the biggest deficit in history—so bad that Chrystia Freeland either got fired or fled before she could be blamedwhen it came in at $64 billion over budget instead of the already reckless $40 billion over.

This is a government that:

And these are the people we’re trusting to negotiate the biggest trade battle of a generation? No wonder investor confidence is at an all-time low, housing is struggling, and our economy is in shambles.

Why I See Hope for Canada’s Future

Here’s the good news: change is coming.

According to the latest polling, the Conservatives lead with 42%, while the Liberals are trailing at 27%. If this holds, we’ll soon have leadership that can actually negotiate for Canada instead of posing for photo ops and lighting taxpayer dollars on fire.

If Pierre Poilievre takes office, I see:

A realignment with the U.S. could be a game-changer, not just for trade but for Canada’s economic standing on the world stage.

What This Means for Real Estate

For now, expect uncertainty—markets don’t like instability, and that’s exactly what we’re getting from this government.

I hope you found this forecast helpful!  As always, feel free to reach out if you’d like to discuss your personal real estate situation

As always, feel free to reach out if you’d like to discuss your personal real estate situation  . I’m here to help! And if you’re curious about how much YOUR home is worth, contact me today for a no-obligation home evaluation!

. I’m here to help! And if you’re curious about how much YOUR home is worth, contact me today for a no-obligation home evaluation!