Hey Friends and Clients!

I hope you all had an amazing August! I know this can be a hectic time of year for many, and it’s no different for our family! So, I’ll get straight to the point with this update and dive into the exciting new stats and insights I’m seeing in the market. There’s plenty to cover, so let’s get into it!

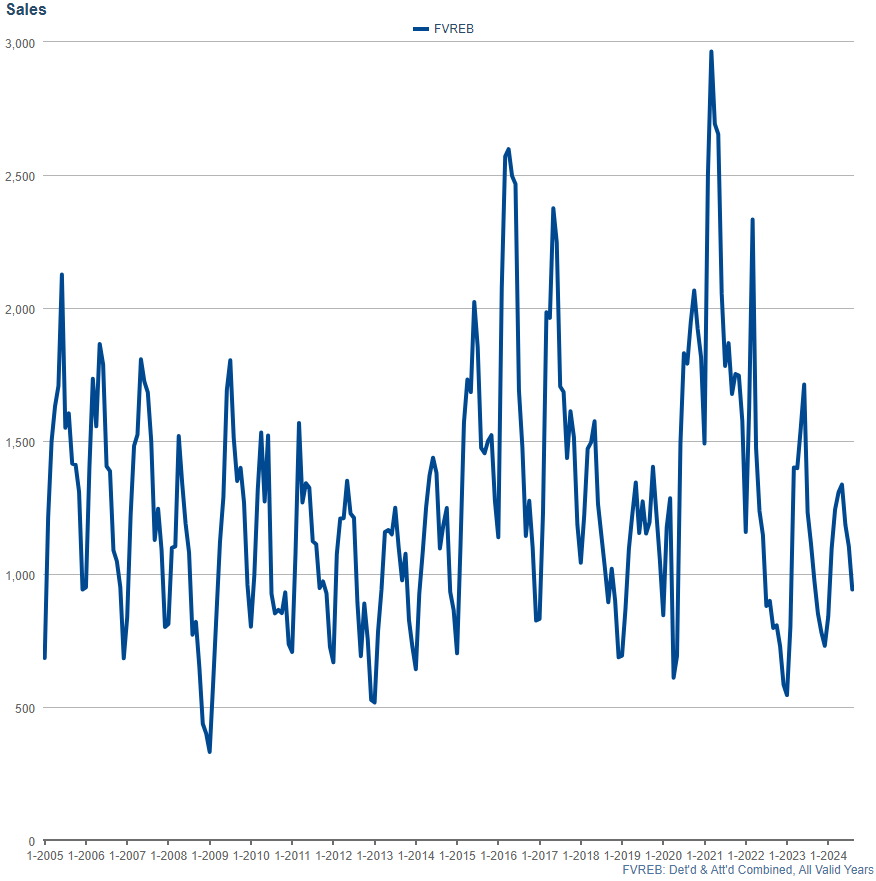

July marks the fourth consecutive month where the Housing Price Index (HPI) for Detached & Attached properties (including Houses, Townhomes, Condos, Duplexes, and Rows) in the Fraser Valley has dropped, following three months of price gains. This was another tough month for sellers, with one of the lowest sales volumes for any August in nearly two decades of recorded history. But there’s plenty more to discuss below!

To start, sales volume dipped again from June to July (from 1,104 to 942, a -15% decline), which was disappointing for many sellers who had hoped the two consecutive 0.25% interest rate cuts would lead to more buyer activity

What’s crucial now is how this August measures up against the last 20 Augusts. Stay tuned!Let’s dive into the numbers!

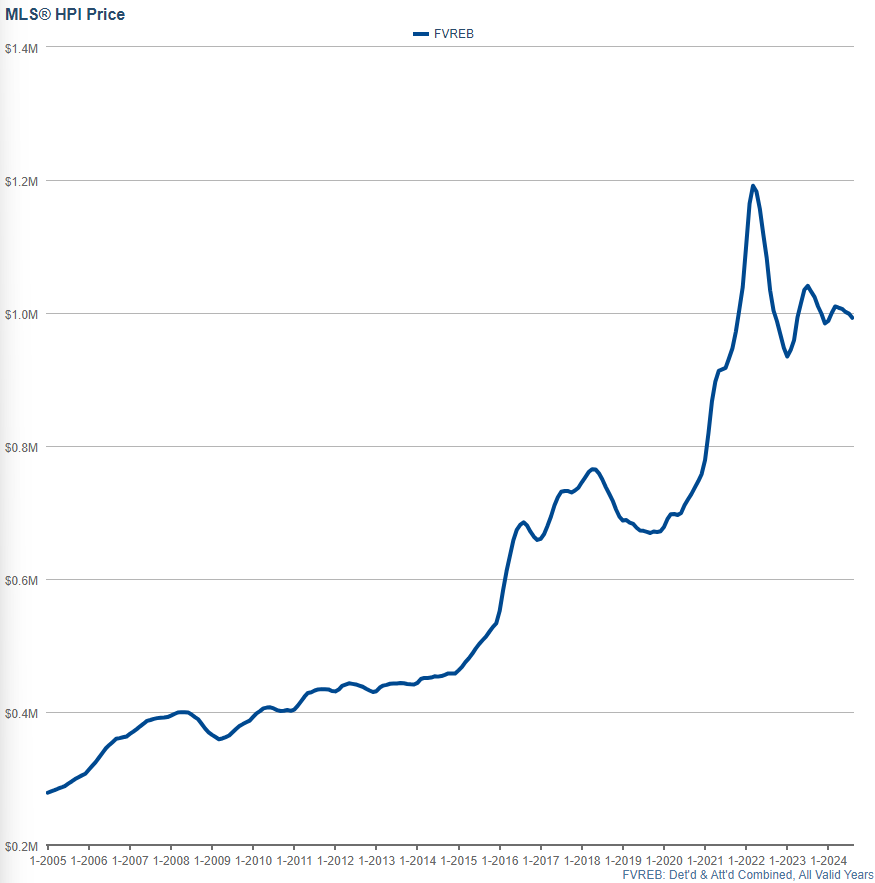

Home Prices

In the Fraser Valley, we’re now seeing the fourth month of decline in the Housing Price Index, covering all property types (Detached, Townhomes, and Condos), following three months of rising prices. For sellers, this continues to be a concern as many were hoping that the interest rate cuts would sustain the upward trend in prices. However, it’s worth noting that despite interest rates being a major factor, prices have dropped in about 80% of the past 19 years between June and August —not necessarily a direct cause, but it’s an interesting point I discovered through deeper analysis.

August 2024: -0.7%

July 2024: -0.3%

June 2024: -0.5%

May 2024: -1.0%

April 2024: +0.5%

March 2024: +1.4%

February 2024: +0.9%

January 2024: -0.3%

December 2023: -1.5%

November 2023: -1.1%

October 2023: -1.4%

September 2023: -0.9%

August 2023: -0.9%

Sales Volume & Sales Ratio

While August experienced a slight dip in prices overall

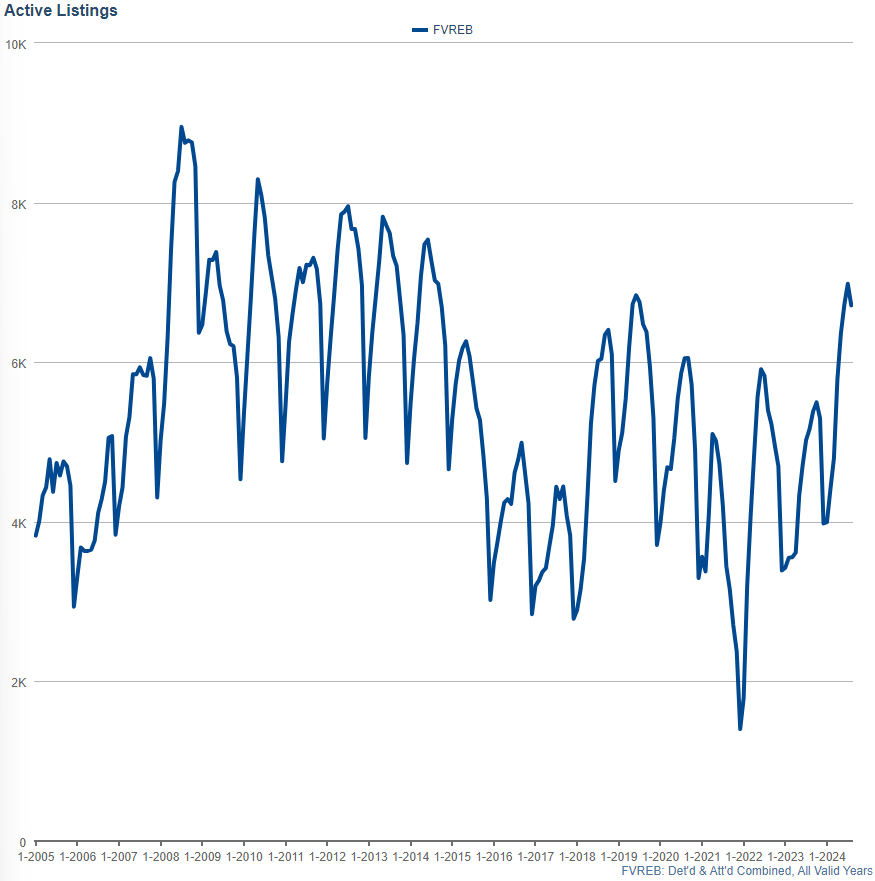

Active Listings

Inventory has finally shown signs of lowering as it came down for the first time after 7 consecutive months of increase… However, it’s important to look at that in context, as nearly every September for the last 19 years had Active Listings Decrease (specifically for Detached and Attached properties combined), with this year’s numbers dropping from 6,982 in July to 6,712 in August, marking a 3.9% decrease… But while July 2024 marked only the 9th highest July in terms of inventory, this August was the 6th highest August for inventory (indicating an average but upward-trending level).

While it’s tough to pinpoint significant trends from the modest increase over the last three months, there has been a noticeable acceleration recently, particularly in areas with high rental property inventory.

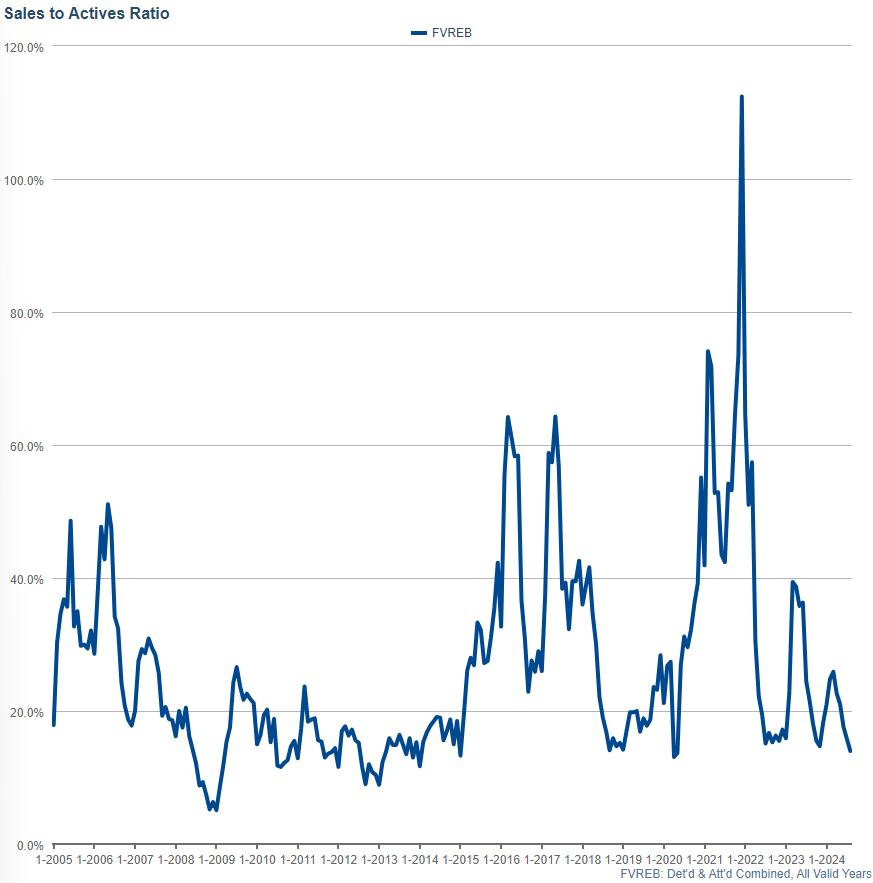

Sales Ratios

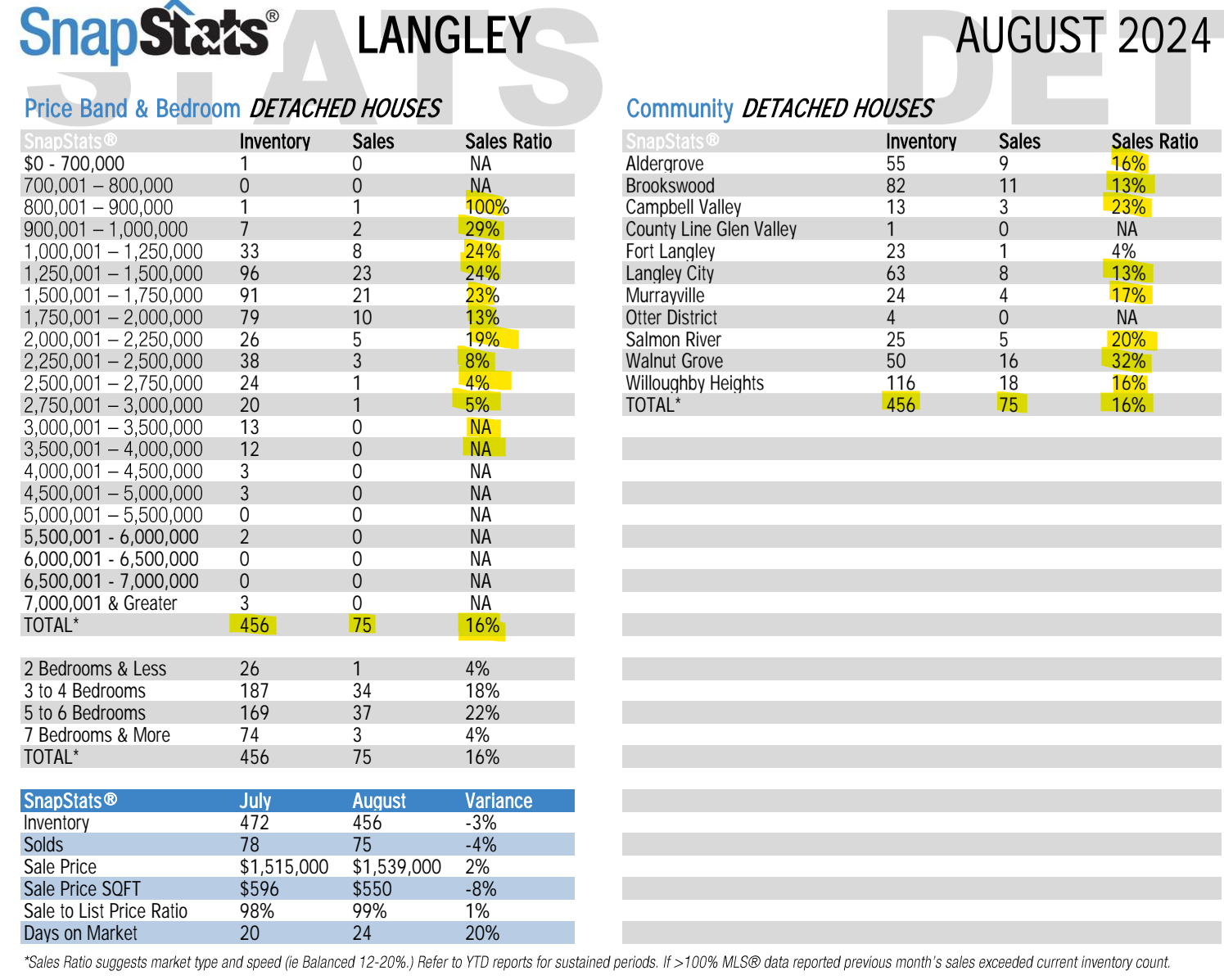

Langley Detached Houses

Just like last month, we’re going to look at a couple of areas in the Fraser Valley, starting with Langley detached houses:

In August, we saw a continuation of trends at an accelerating pace. While there were slightly fewer listings, there were far fewer sales, resulting in lower ratios everywhere, and the higher up in price you go, the worse the story is.

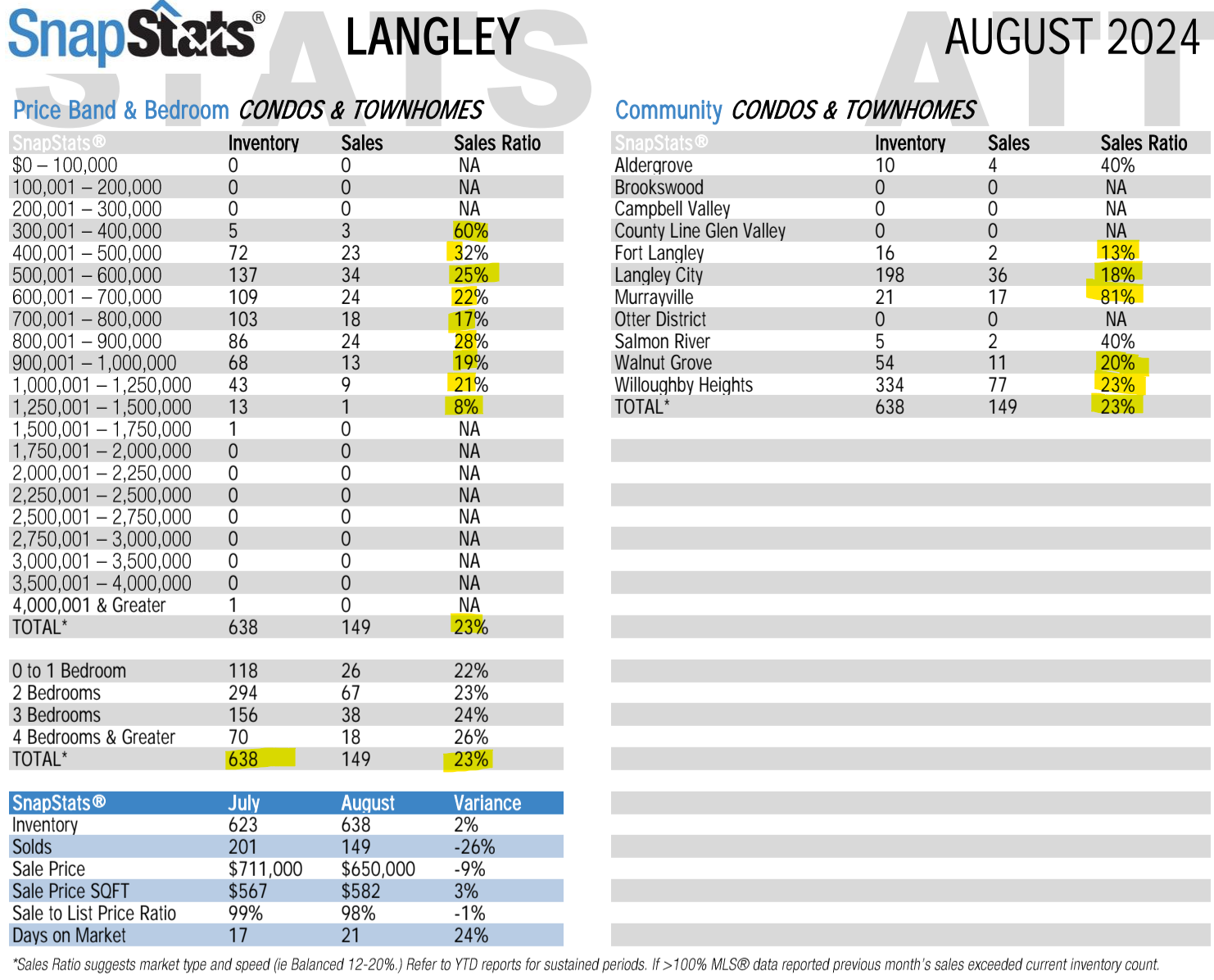

Condos and Townhomes

For condos and townhomes, the story is a bit more positive, with many areas still showing a balanced market. The situation hasn’t been quite as challenging as it’s been for higher-priced detached homes or acreages, but sales ratios still fell (stay tuned 2 pics down!).

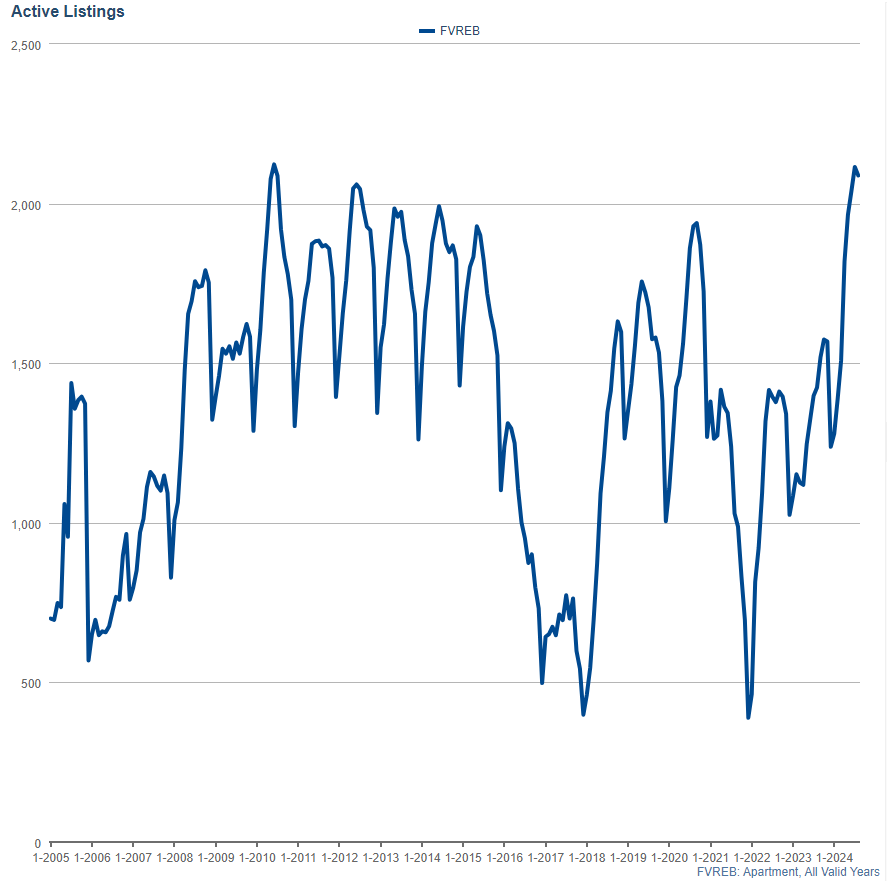

So that’s the Langley Condo and Townhome market that wasn’t looking too bad…but now we’ll have a look at the Overall Fraser Valley Condo Market overall for comparison. The Condo market represents a large portion of the Strata market and that’s what should concern you if you own a condo right now and need to sell it.

August 2024 is a milestone but not in a positive way. It marks the #1 highest inventory August ever recorded for condos in the Fraser Valley out of 19 Augusts.

For comparison, July was the 3rd highest so this again indicates further softening in the market.

My Forecasting:

Here’s my quick (well, who am I kidding—maybe not so quick!

That being said, we just had our third consecutive rate cut this past September 4th, and the jury is still out on how much that’s affecting the market

The rental market is still punishing landlords with these high rates

I hope you found this forecast helpful!