I hope you had a wonderful September!

I hope you had a wonderful September!

I know with school starting many of you have just come off a very busy month!

For many it can be the busiest month of the year. My wife Tina and I share that same feeling as we send our little guy off to his first year of HIGH SCHOOL! Oh boy, Everybody wish me luck, ha ha!

It’s been a month since I sent out a FULL Market Update so let’s jump right in!

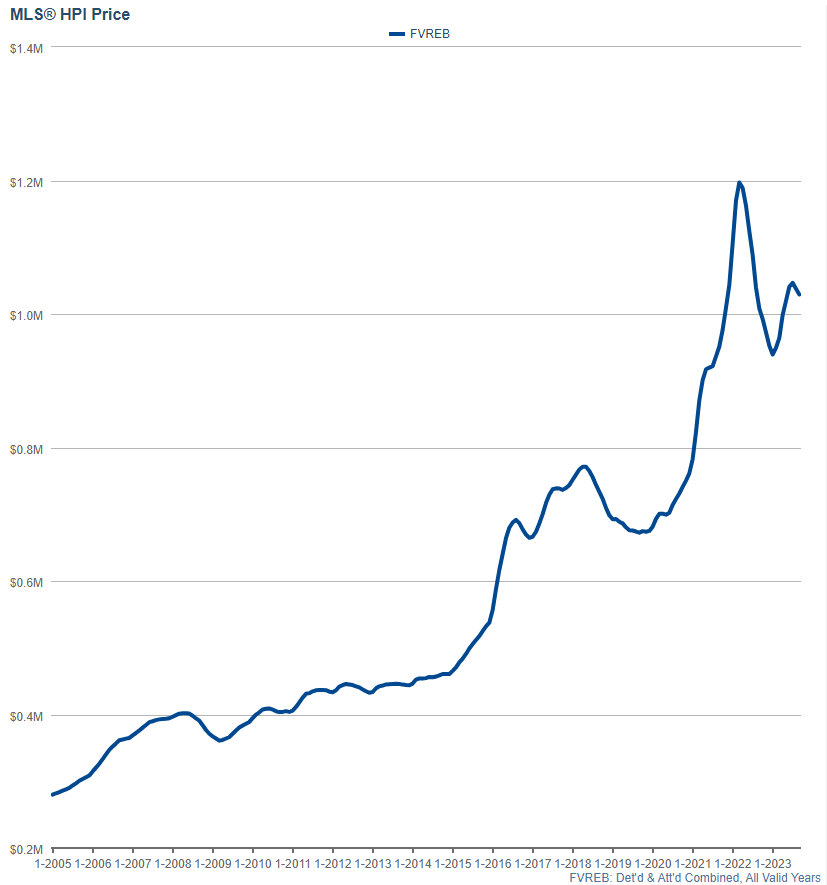

Home Prices

September saw a continuation of the price decline that started earlier this year in mid-July.

Overall, in Combined Detached & Attached housing in the Fraser Valley, we saw HPI (Housing Price Index) decrease 0.9% from August, which is the same as it decreased in August from July.

Another way to look at prices is that now prices are back down to where they were roughly in the following months:

May 2023 (while prices were increasing until July 2023)

September 2022 (which also marked the second slowest September in recorded history for sales volume)

November 2021 (this is when prices were increasing by single digit % per week in the frenzy of record low interest rates!).

We’ll come back to prices soon…

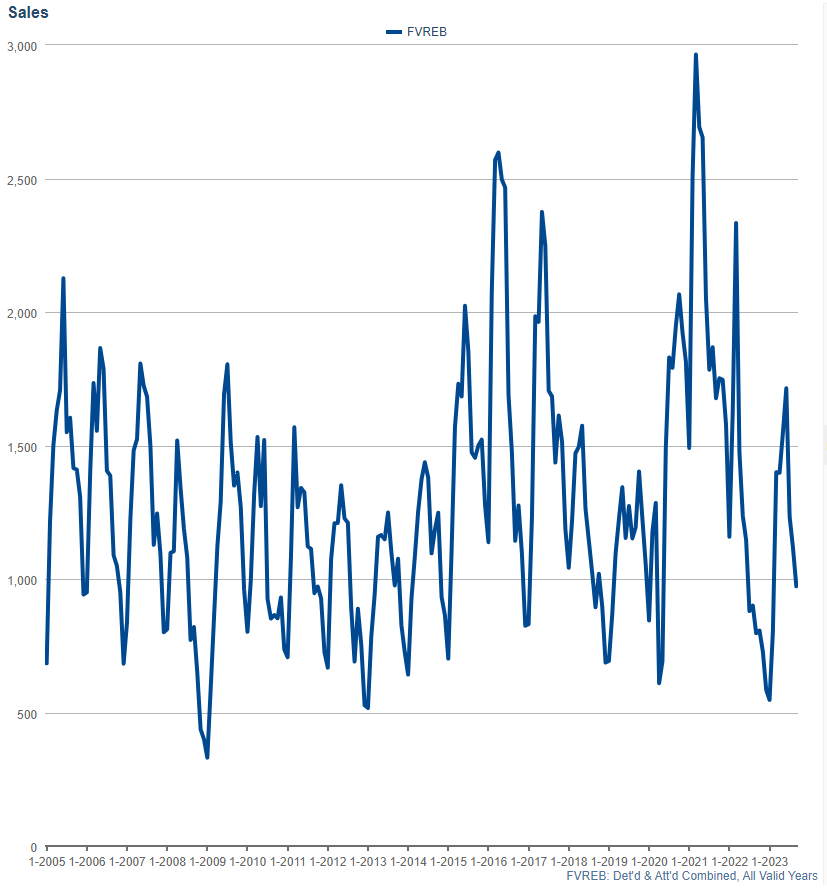

Let’s move forward and talk about: Sales Volume

While September not only saw price fall nearly 1% since last month, it also had sales volume drop to near-record breaking lows for the month with only 973 posted sales.

This marks the third lowest sales volume for the month of September ever recorded.

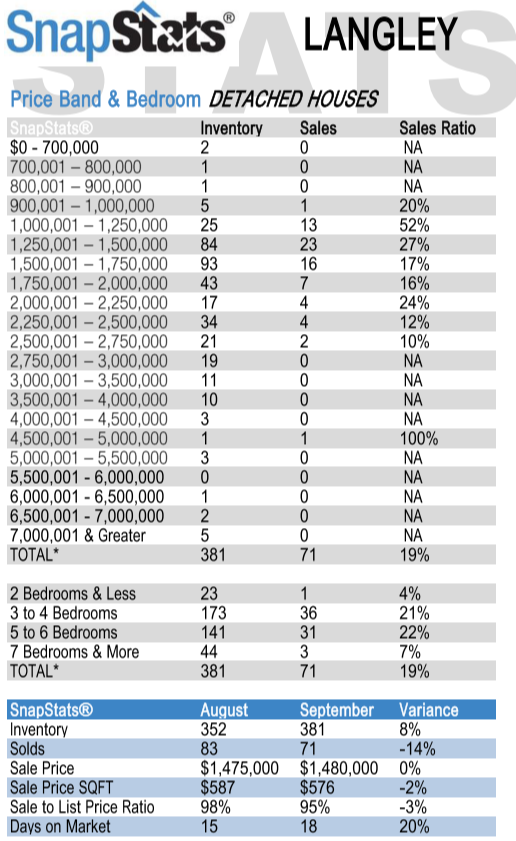

Next let’s briefly review What is selling, and let’s use Langley Detached Homes again this month as a sample market to analyze below:

From the table above, you can see that when you take a closer look that there is a decent sales ratio between $1,000,000 to $1,500,000 (52%), yet as you go up in price, that ratio dramatically decreases.

Once you look above $2.5M, essentially nothing is selling.

There were just 3 sales above that range (out of the 76 in that same range!). This is similar in most Fraser Valley areas.

If you own a luxury property right now and have it up on the market, chances are your listing has been very quiet.

If your listing was a 1 bedroom condo however, lots of those price points are still quite active!

Now If that update wasn’t full of enough good news for you, it gets better…

Listings

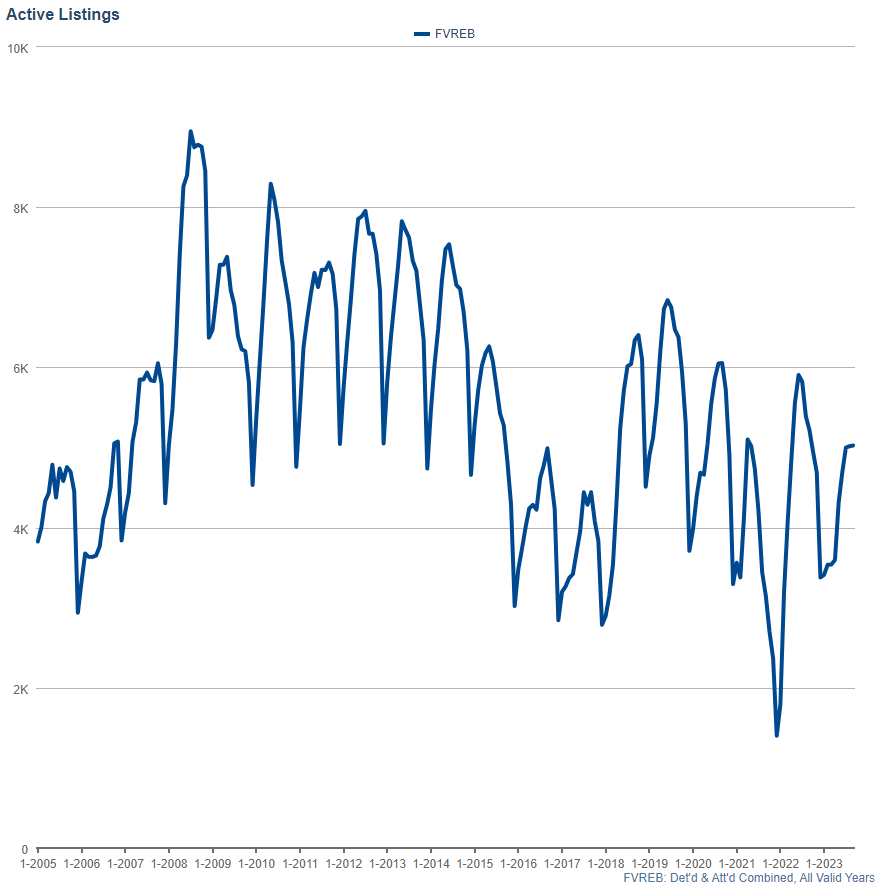

While both prices and sales volume decreased in September, one might expect the number of active listings to possibly increase based on the low sales volume, but instead inventory remained almost the exact same, increasing from 5,015 to 5,017 (which is essentially the exact same!).

This marks the fourth lowest number of active listings ever recorded for a September.

And let’s pause here for a second – why do I state this is bad news? Well here’s one reason…

If prices are falling now with inventory near record lows, what will happen when inventory increases, in a scenario where it has only up to go?

…Well if we go back to the regular laws of supply vs demand we would see that an increased supply, (isolated from other factors) would put negative pressure on the valuations and cause prices to come down (and in this case, accellerate the fire with even more fuel)!

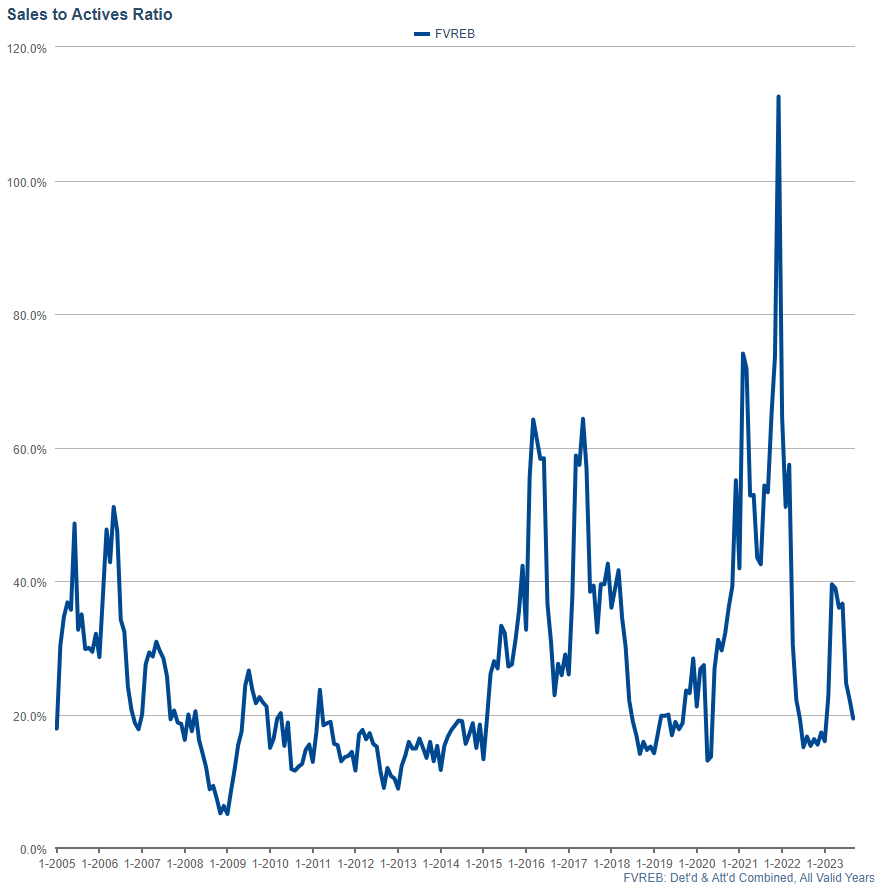

The below graph is also very telling because it represents the ratio between how many sales occur in a month vs how many active listings are on the market.

The higher the ratio, the more of a sellers market it is and the lower the ratio, the more of a buyers market it is.

If there are 100 homes listed and 20 sell, for example, we’d say that there was a 20% Sales to Actives Ratio.

Currently for the month of September, we saw an overall sales ratio for the Fraser Valley of 19.4% (don’t forget about the differences per price point though… the over $2.5M range is very quiet!)

My Forecasting:

SO this month I’ll keep it simple and straight to the point because I believe we need only look at these few following factors to guide us to where the market is likely headed:

1.) Mortgages Rates

With rates so high now for new mortgages, it’s important to consider just how many Canadians are paying these higher new rates and how many might be on lower fixed rates that haven’t renewed yet.

According to the Bank of Canada as of July 2023, “About one-third of mortgage holders have already seen their rates increase, and the Bank of Canada forecasts that just about every borrower will experience the same in the next three years. (Daniel Munoz/Reuters)”. This stat is factoring in all mortgage types, both fixed and variable.

If prices are already falling and 2/3 of Canadians haven’t even felt the pain of these rates yet, one can only assume things could likely get worse.

To what degree is hard to say but it doesn’t sound good. And many will say that interest rates will likely be lower (than today) in 2024 and into 2025, which is likely true, but still would likely be far higher than the record low levels of 2020.

https://www.cbc.ca/news/business/mortgage-renewals-1.6905403

2.) Rental Property Cash Flows

With interest rates as high as they are, and likely to remain higher, for longer, rental properties have become dramatically different to own.

Someone who purchased a home at 3% interest rates, might have the rent cover all the expenses of the house referred to as “breaking even” OR may have potentially had some positive cashflow if the home had a secondary suite or the like.

The difference is NOW, that same rental property (at 6% to 7% interest) may be negative cash flowing anywhere from $500 to $4,000 a MONTH!

This is something that is becoming more and more untenable and this has and will continue to lead to more rental properties having to be sold due to not being able to afford that much per month.

In BC, nearly a quarter of all homes are owned by investors. 1/3 of all condos are investor owned. This is more than any other province, so this could have a major impact.

https://storeys.com/statistics-canada-residential-real-estate-investor-data-british-columbia-vancouver/#:~:text=Among%20investors%2C%20houses%20are%20less,popular%20among%20investors%20than%20houses.

3.) Inflation

Canada’s Inflation Rate is back up to 4% as of August, up from its recent low of 2.81% in June.

This is now the second increase in a row.

Rent, groceries, and energy costs (not reflected in that inflation number, but factored in nonetheless) have skyrocketed across Canada and especially in our Fraser Valley and Vancouver areas.

The Bank of Canada has a mandate to keep inflation between 1% and 3% and it is unlikely that they will start lowering the interest rates until they achieve that goal or something close to it.

When we factor in how many months that might take to happen and then how long to proceed before the first decrease in rates – there is no way to be sure!

I estimate rates start coming down a little bit sometime around mid to end 2024. I’ve seen arguments for it being a bit sooner and some as long as the end of 2025 but there are too many factors to know exactly!

WHAT SHOULD YOU DO?

This question gets more complicated every month 🤣!

Essentially if you are a first-time home buyer, I would make sure you are fully pre-approved and working with your realtor now to get sent listings.

Regardless if you aren’t going to buy right away, you’ll want to get your financing in order and explore that fully with your broker/banker/realtor to see what’s possible, and then from there you can have a much better idea of what to expect.

Then you can see if it makes sense to purchase something now or whether you want to possibly wait. There are trade-offs when it comes to interest rates and speculating the market – it’s always best to have more information than less 🙂

If you are upsizing, now may be one of the best times to consider making the move as you’ll “save” far more than you’ll “lose” peak to trough of the current market.

The higher priced homes have come down farther than your lower priced home and the delta between those numbers has decreased for many making a move that was impossible before in the rising market, possible now.

If you are downsizing, I would be exploring options with your broker and realtor to see if there’s a way to accomplish your goals sooner rather than later or possibly even consider other options. Much of all of this would depend on the stage of life you’re in and if you’re retired and/or have a working income etc.

As always, I hope you found this helpful and please reach out any time with any questions or feedback!

Cheers!

Until next time,

– Corbin

Corbin Chivers

Personal Real Estate Corporation

REALTOR®

corbin@callcorbin.ca

www.facebook.com/callcorbin

www.callcorbin.ca