With the holiday season fast approaching 🎄⛄❄️ I know it’s a very busy month for many of you! For others, I know it can be a nice quiet time of year to relax and get out of your daily routine or grind! Regardless of how you like to spend this time of year I hope you get to spend it with your loved ones doing something you enjoy!

Now, let’s skip the small talk and get right into why you’re reading this article right now…📈📉😮!

I wish my predictions over the past few months were wrong but…

This has been one of the slowest months for sales volume since I’ve been in the business (nearly 10 years); Objectively, November proved to have one of the lowest sales volumes ever recorded 📉📉📉! When compared to previous November’s in the past 18 years, November 2023 was the 4th slowest on record with just 826 total sales. In terms of the sales ratio, this past November had an overall sale ratio of 15.5% in the Fraser Valley (with about half the neighbourhoods in the single digits). This % by itself may not sound like the worst ratio we have ever seen on their own, however when you look at what is selling (we will below) you’ll find that while the lower priced homes are still selling, (albeit at a relatively low ratio), it’s a very different situation with higher priced homes simply not selling, (often at all!)

Where shall we start? Let’s start with…

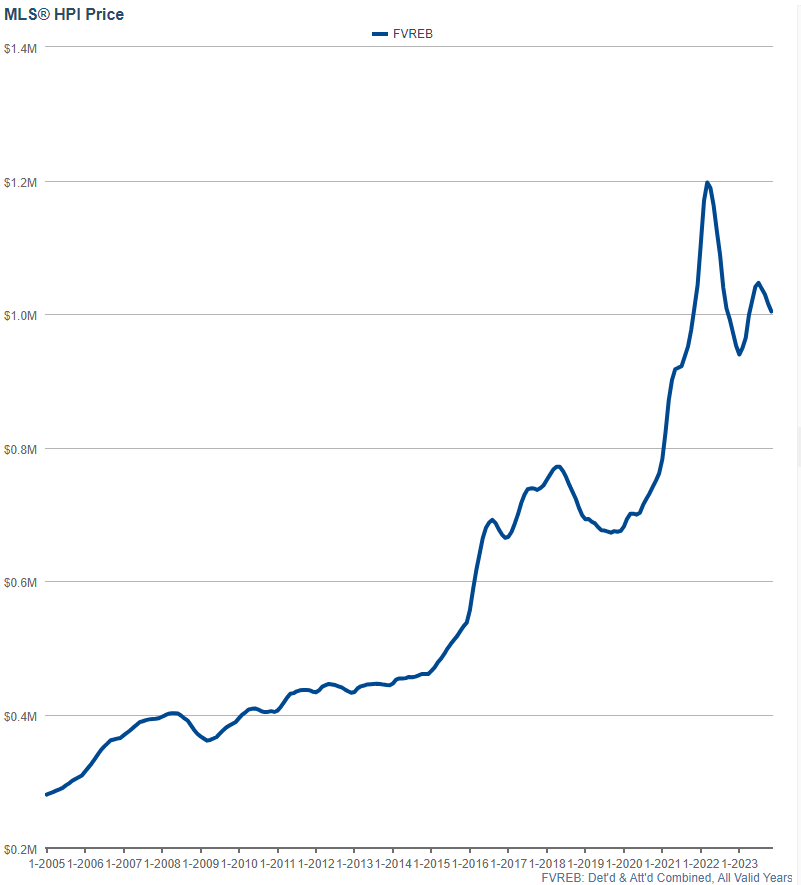

Home Prices

Overall in the Fraser Valley, we saw yet another month of decline, marking the 5th consecutive month that prices have fallen:

- November (-1.1%)

- October (-1.4%)

- September (-0.9%)

- August (-0.9%)

- July (+0.5%, but started declining halfway through month)

Another way of looking at today’s prices is to compare them to a previous time when the market Another way to look at prices is that now prices are back down to where they were roughly in the following months (Rounded to the nearest month, so YES you will see this reads same as last month, just barely 😉):

- April 2023 (while prices were increasing until July 2023)

- September 2022 (which also marked the second-slowest September in recorded history for sales volume)

- November 2021 (this is when prices were increasing by a single digit % per week in the frenzy of record-low interest rates!).

Now let’s shift gears to see just how many homes are selling and what kinds of homes, and where!

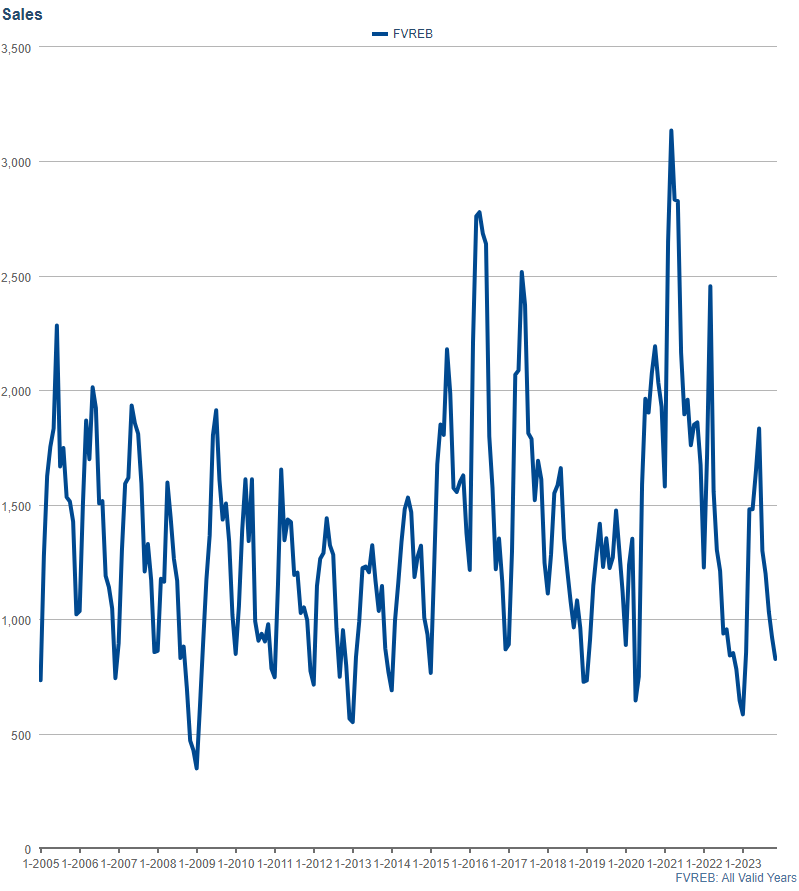

Sales Volume & Sales Ratio:

While November saw prices drop by 1.1%, it also saw sales volume drop to one of the lowest levels in history with (As mentioned above) November 2023 being the fourth slowest on record.

This is the Fraser Valley Sales Volume below:

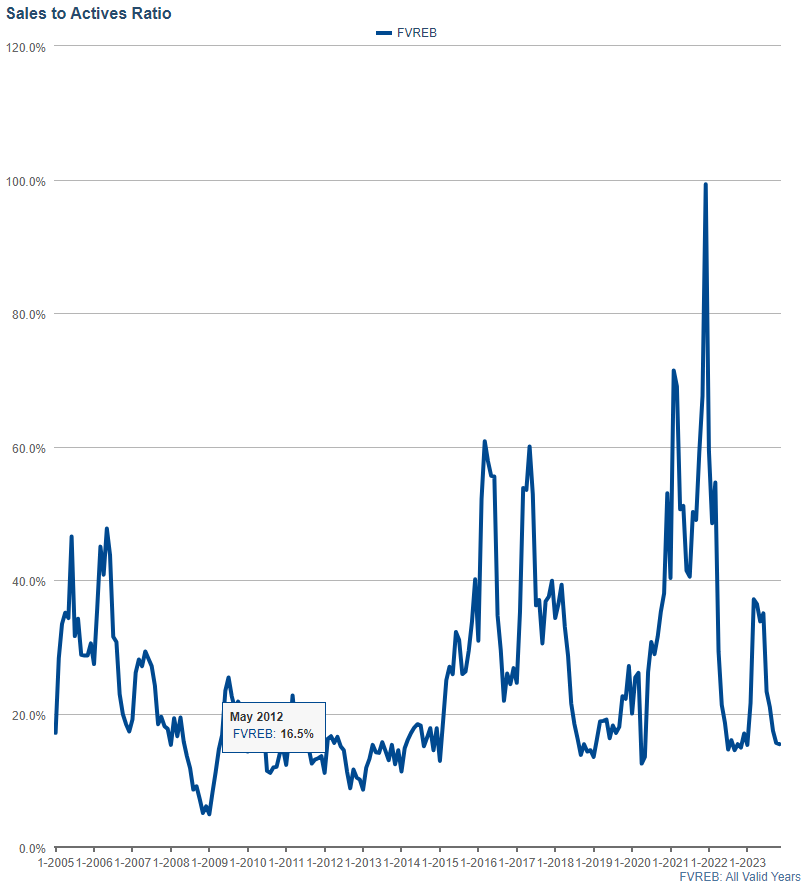

And then Sales ratios (The number of listings that sell as a % of active listings in any given area) dropped to an overall 15.5%.

What’s not broken down in this graph however is the different ratios in differentprice points, or areas…(Stay tuned for the full breakdown below which might shock you 😯😅)

This is the Fraser Valley Sales Ratio Below:

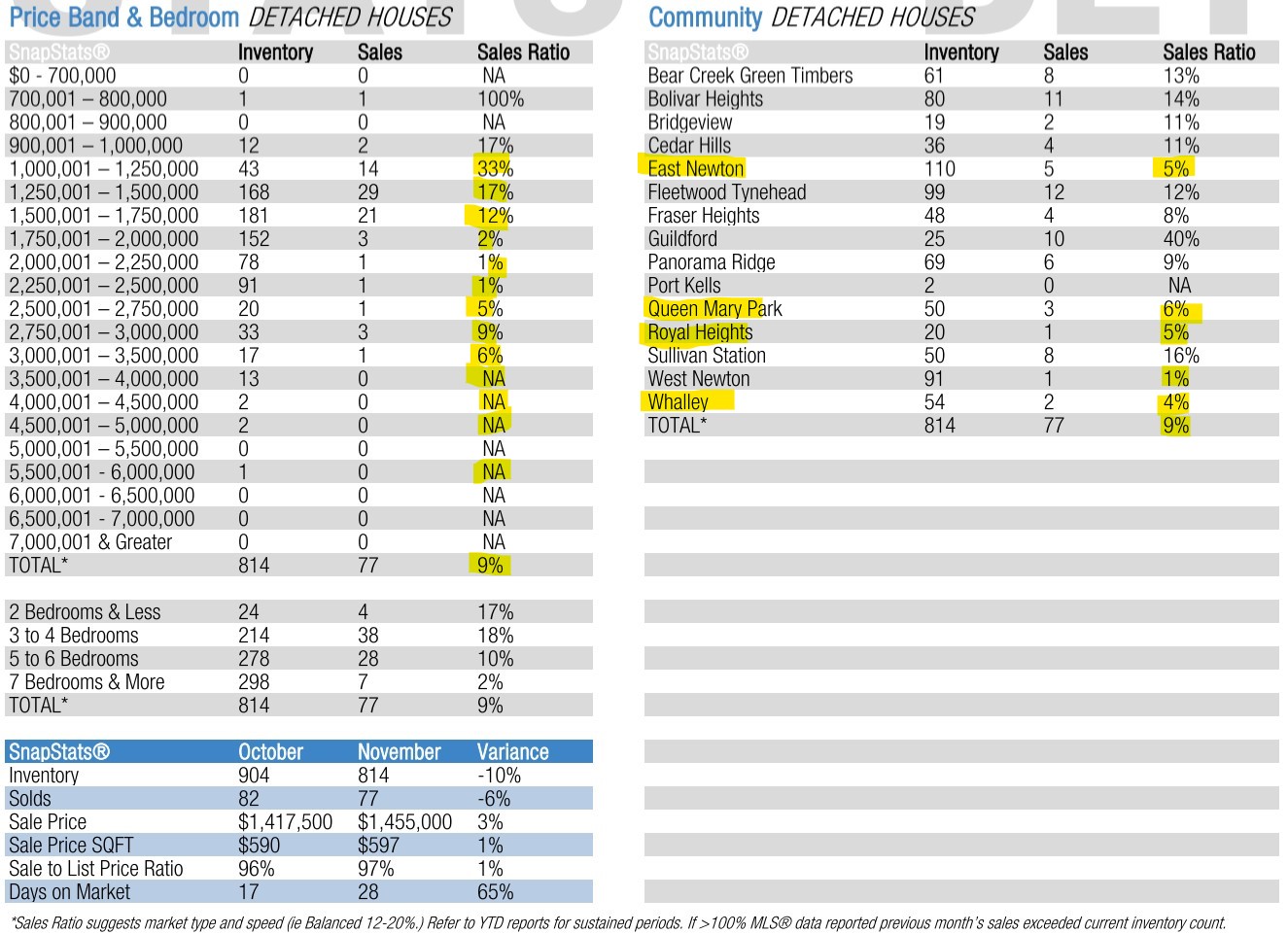

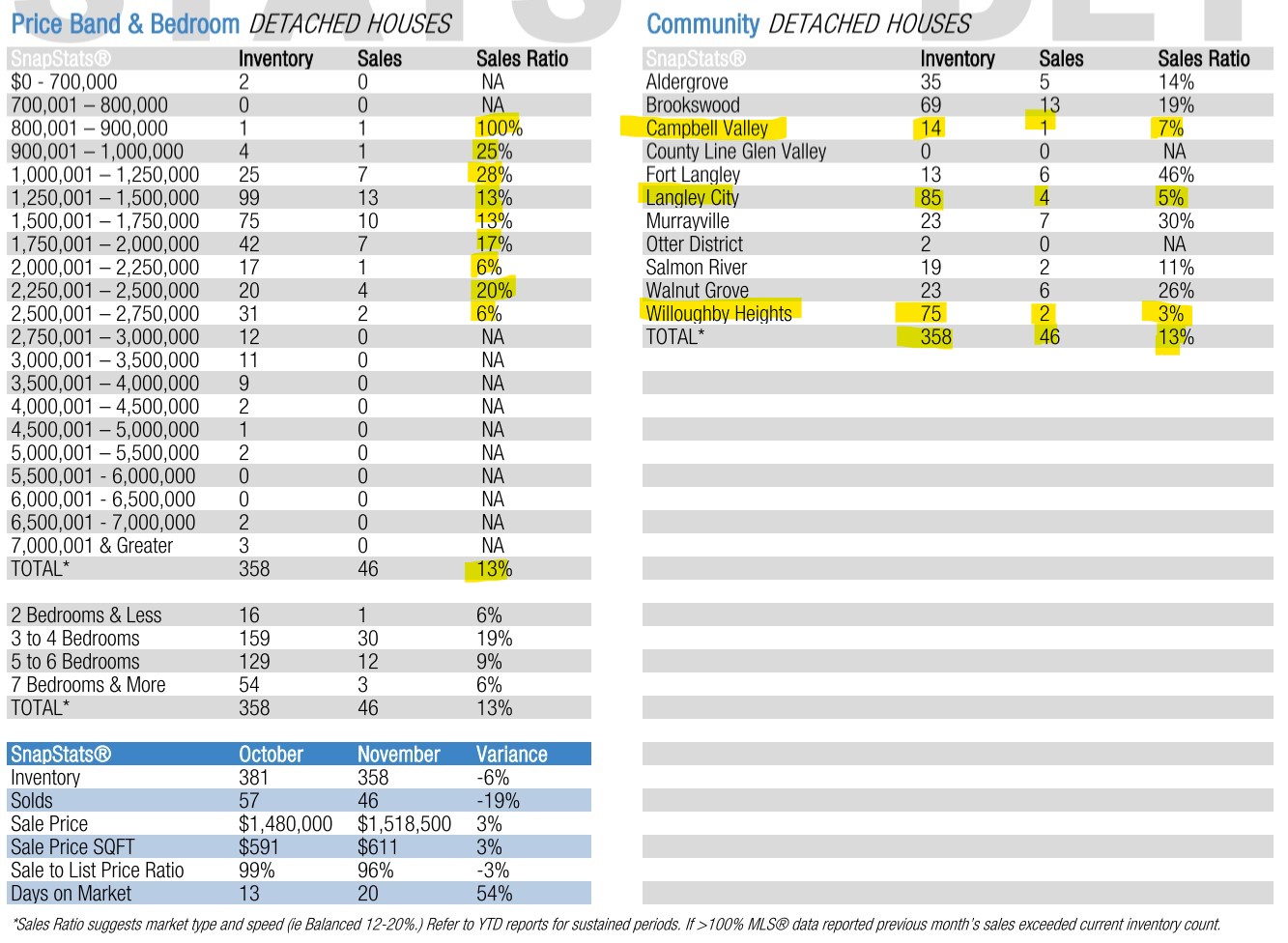

Now let’s jump into what is selling! We’ll use Two Areas, Surrey & Langley Detached Home Sales for a deeper dive:

When you examine both of these cities you will see that homes between $1,000,000 and $1,250,000 are selling at a decent sales ratio of 33% and 28%respectively…But when you increase the price range to homes between $1,250,000 to $1,500,000 the sale ratios drop to 17% and 13%respectively….but…then once you go to homes above $1,750,000 the sales ratios drop to…wait for it..brace yourself…9.3% (Langley) and 2.4% (Surrey)!

The bottom line is sales ratios fell into single digits in about half of the Fraser Valley for Detached homes. Some areas reached absolute new lows never seen since 2008/2009, such as Willoughby Heights with 2 Sales out of 75 Active Listings (3%), Langley City with 4 sales on 85 Active Listings (5%), and West Newton with 1 Sale out of 91 Listings

Something of important notice is the vast difference between different areas. For example, in Murrayville there is a healthy 30% Sales Ratio, 26% in Walnut Grove, and a staggering 46% in Fort Langley.

Surrey Detached

Langley Detached

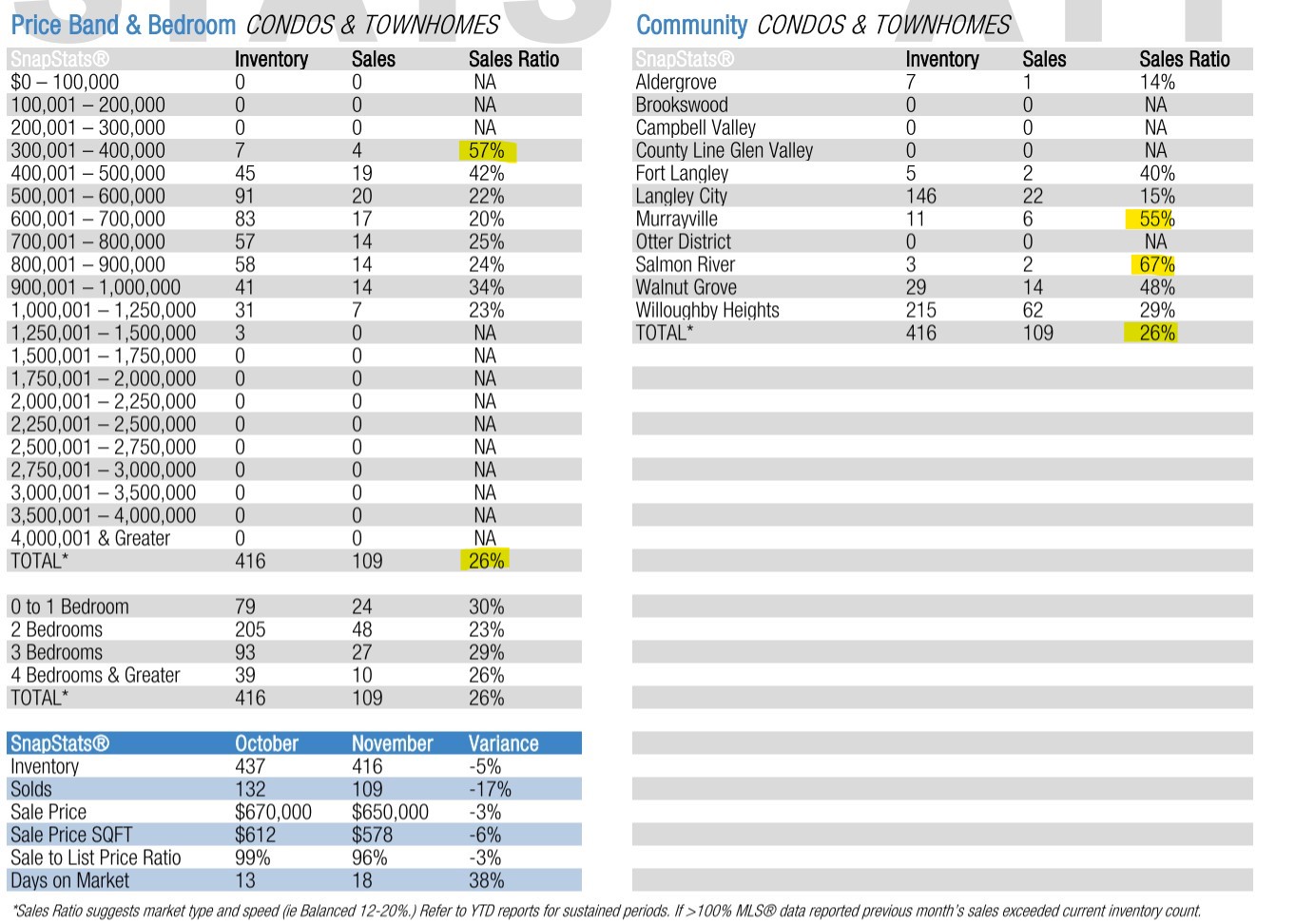

Now it’s not all bad news out there… Condos and Townhomes are fortunately a very different story than more expensive detached homes! Let me draw your attention to the table below and you’ll see what I mean:

Langley Attached

This above table shows the condos and townhomes in Langley. You can see that we had a strong 26% overall sales ratio, with condos prices between $300,000 and $400,000 selling at a very high 57% ratio! This is very encouraging information for many condo and townhome owners who are looking to sell – YES – Yes you CAN sell ! 🙂

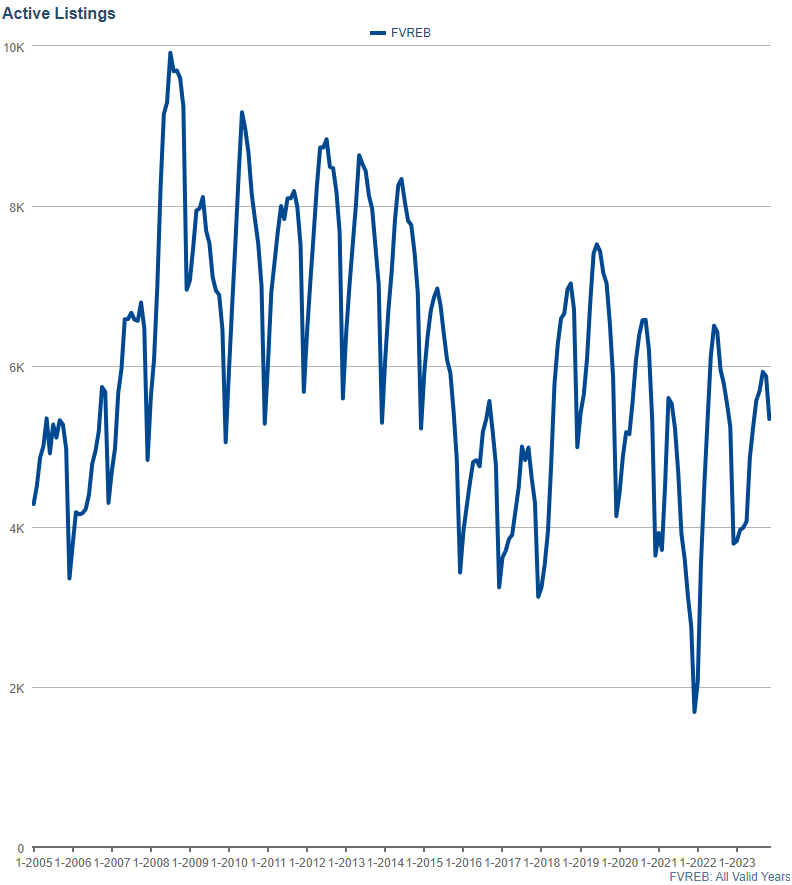

Lastly, let’s have a look at the inventory!

Listings

While we saw both prices and sales volume fall overall in the Fraser Valley last month, we also saw Listings drop 10% from 5,877 active listingsto 5,343 by November 30th, 2023. And just how does this stack up to the previous November? And just what sort of relationship with sales volume numbers is this having? This marks the seventh-lowest number of active listings ever recorded for November…(October was the seventh lowest October too) but this is compared to the fourth-lowest number of active listings in September. This would seem like inventory in relative terms is increasing despite actually falling. And what does this mean if we have inventory still relatively low (just starting to increase), while prices are already falling rapidly? Well if we go back to the regular laws of supply vs demand we would see that an increased supply, (isolated from other factors) would put negative pressure on the valuations and cause prices to come down (and in this case, accelerate the fire with even more fuel)!

My Forecasting:

I’ll try and keep it short and sweet (let’s be honest, do I ever do this?😅🤣!) and lay out 3 key factors I’m weighing heavily in what I predict for the future:

1 & 2.) Mortgage Rates/Inflation:

I think many were a little relieved on December 6 when the Bank of Canada announced a pause on their Policy Rate, keeping it at 5%. Up until the last 6-8 weeks, there were still many economists predicting a possible further hike. With rates so high now for new mortgages, it’s important to consider just how many Canadians are paying these higher new rates and how many might be on lower fixed rates that haven’t renewed yet. And when it comes to inflation we have come down to 3.1%, which isn’t too bad until you reflect that it’s rebounded up and down all year since a low of 2.8% in June and 3.8% in September.

As for the latest data, I have it all here!

A recent report (Oct 2023, sURVEY) released by Royal LePage suggests over three million Canadians are facing mortgage renewals in the next 18 months.

“Key highlights from the release include:”

- 31% of all mortgages in Canada say their lending agreement is set to renew within the next 18 months, meaning that 3.4 million Canadians have a mortgage set to renew by March 2025.

- Almost three-quarters (74%) of Canadian mortgage holders currently have a fixed-rate mortgage; 20% have a variable-rate mortgage.

- 40% of variable-rate or hybrid mortgage holders concerned about their upcoming renewal say they plan to switch to a fixed rate.

- 64% of variable-rate or hybrid mortgage holders say that higher interest rates have caused their mortgage payment to hit its trigger rate and thus increased their monthly cost.

- 76% of variable-rate or hybrid mortgage holders say that higher interest rates have caused financial strain on their household, causing them to reduce spending and dip into savings.

Additionally, One CMHC Researcher, Tania Ochoa says 2.2 million borrowers will be renewing in 2024 and 2025, representing 45% of all outstanding Canadian Mortgages.

And it’s going to depend on the current interest rates and the previous rates the borrowers had to know how much of a “mortgage rate shock” there could be so let’s consider the following big question, “When are interest rates going to start coming down?” Then next we’d want to know, “by how much, and how fast?” And heck if you actually could know that 100%, you’d be a bajillionaire! So…let’s have a look at what different experts are saying and their reasoning to at least establish what’s the “Best case” vs “worst case” outlooks that are being argued out there.

Recently Bloomberg curated the opinion of several senior economists at top Canadian Banks and even had many of them on their business program. Rather than forcing you to watch their entire program 😅🤣(link below) I’ve summarized their timelines (more or less) below!

The most favourable outlook (which was shared by several top economists including Director of TD Economics, James Orlando) is that interest rates will start being cut in April 2024 once inflation stabilizes under 3% for several months. Then there are economists such as Douglas Porter, Chief Economist at Bank of Montreal who think our economy “isn’t showing signs of further deterioration early in Q4” so he doesn’t think rates will be cut until later in the year.

I am personally more persuaded by the arguments that rates will be cut sometime around the April 2024 announcement…however with prices on the decline I estimate home prices will get worse before they get better. Maybe as much as 5% to 10% before they start increasing again.

https://royallepageleadingedge.ca/royal-lepage-2023-mortgage-renewal-survey/

https://www.bnnbloomberg.ca/bank-of-canada-rate-decision-what-economists-expect-1.2006049

3.) Rental Property Cash Flows

This section remains the same as last month FYI:

With interest rates as high as they are, and likely to remain higher, for longer, rental properties have become dramatically different to own. Someone who purchased a home at 3% interest rates, might have the rent cover all the expenses of the house referred to as “breaking even” OR may have potentially had some positive cashflow if the home had a secondary suite or the like. The difference is NOW, that same rental property (at 6% to 7% interest) may be negative cash flowing anywhere from $500 to $4,000 a MONTH! This is something that is becoming more and more untenable and this has and will continue to lead to more rental properties having to be sold due to not being able to afford that much per month.

In BC, nearly a quarter of all homes are owned by investors. 1/3 of all condos are investor-owned. This is more than any other province so this could have a major impact.

https://vancouver.citynews.ca/2023/02/03/bc-condos-investor-owned/

WHAT SHOULD YOU DO?

This month, like every month, it really depends on your situation!

Because much of the data this month is a continuation of what we were seeing last month with similar forecasting, my advice is nearly the same.

Essentially if you are a first-time home buyer, I would make sure you are fully pre-approved and working with your realtor now to get sent listings. Regardless if you aren’t going to buy right away. You’ll want to get your financing in order and explore that fully with your broker/banker/realtor to see what’s possible and then from there, you can have a much better idea of what to expect. Then you can see if it makes sense to purchase something now or whether you want to possibly wait. There are trade-offs when it comes to interest rates and speculating the market – always best to have more information than less 🙂

If you are upsizing then now may be one of the best times to consider making the move as you’ll “save” far more than you’ll “lose” peak to trough of the current market. The higher priced homes have come down farther than your lower priced home and the delta between those numbers has decreased for many making a move that was impossible before in the rising market, possible now.

If you are downsizing then I would recommend considering either listing your home in the short term, before prices dip further (if your home price is still at a sales ratio that’s currently selling). Or I would be advising that the next time to consider selling would be the Spring when we see ratios increase and likely see a faster sale. This is when I foresee the volume of transactions picking up dramatically as interest rates likely have their first cut. The only problem with this, is I also forecast prices to be lower by this time than they are now, and then a period of months and likely multiple rate cuts needed for prices to recover to today’s prices (despite todays’ low sales ratio)…So then you might be waiting until Summer for prices to be higher than now…but lots can change untl then SO…stay tuned for next month’s update! Thanks for reading until the end!

I hope you found this helpful and as always, please reach out if you’d like to chat about your personal real estate situation and I’d love to help you out!

And if you’re interested in how much YOUR home is worth – please reach out today for a no obligation home evaluation 🏠!

Cheers!

Corbin Chivers

Personal Real Estate Corporation

REALTOR®

corbin@callcorbin.ca

www.facebook.com/callcorbin

www.callcorbin.ca