Moving onto the comprehensive market update,we’ve got plenty to discuss, so let’s get started!

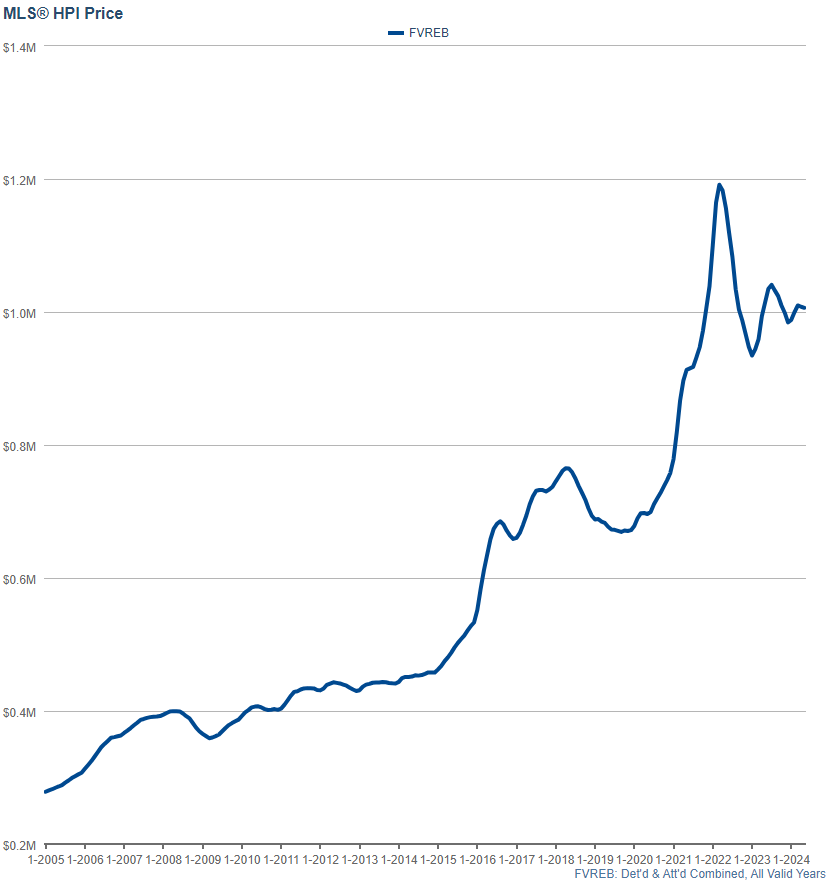

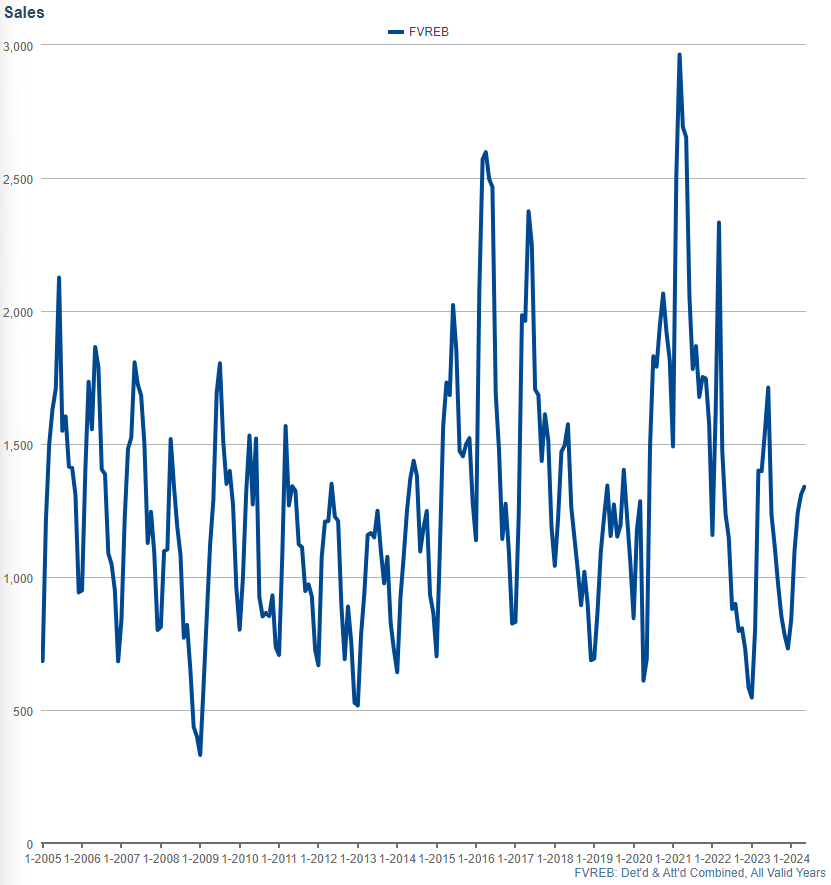

This May marks a shift in momentum for sale prices, with the Housing Price Index (HPI) decreasing in Detached & Attached homes (including houses, townhomes, and condos) after three months of continuous price increases. Sellers might feel concerned (and understandably so), but there’s more to the story! But first, a quick update on Sales Volume: it remained steady at 1,339 sales compared to April’s 1,310. However, increased inventory brought down the sales ratios. The crucial question is, how does this May compare to the last 20 Mays? Stay tuned!

Now, let’s dive into the stats!

Home Prices

In the Fraser Valley, May marks the first decline in the HPI for Detached & Attached homes after three months of rising prices. While detached homes saw a slight increase (0.2%), the combined categories fell by 1.0% due to declines in condo and townhome prices. This might be worrying for sellers who hoped for continued price increases. Some believe the recent interest rate cut will attract more buyers and push prices up, but can this offset the significant inventory growth we’re seeing almost everywhere?

May 2024 -1.0%

April 2024 +0.5%

March 2024 +1.4%

February 2024: +0.9%

January 2024 : -0.3%

December 2023 : -1.5%

November 2023: -1.1%

October 2023: -1.4%

September 2023: -0.9%

August 2023: -0.9%

July 2023: +0.5% (but started declining halfway through the month)

Sales Volume & Sales Ratio:

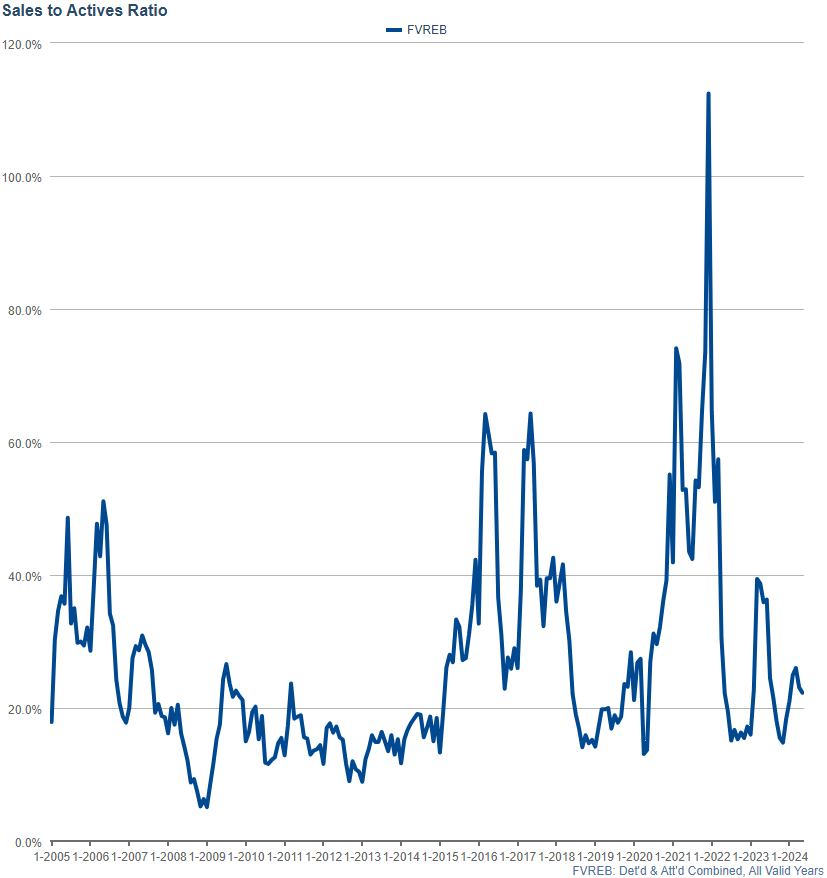

While May saw prices decrease by full percent overall, it also saw Sales Volume increase (Detached & Attached Combined) remain almost unchanged from 1.310 sales in April to 1,339 in May. This marks just a 0.2 % INCREASE over April 2024 and ranks as the 7th lowest April in the last 19 years of tracking. So definitely far lower than we’re used to seeing in recent history with the exception of 2022. You’ll also see below that Listings went up more, actually bringing sales ratios down unfortunately.

Sales Ratios

Sales ratios (the percentage of listings that sell out of the total active listings in a given area) dropped again, now at 22.3% from the previous 23.1%

And just like last month, we’re going to have a look at a couple of areas in the Fraser Valley, starting off with:

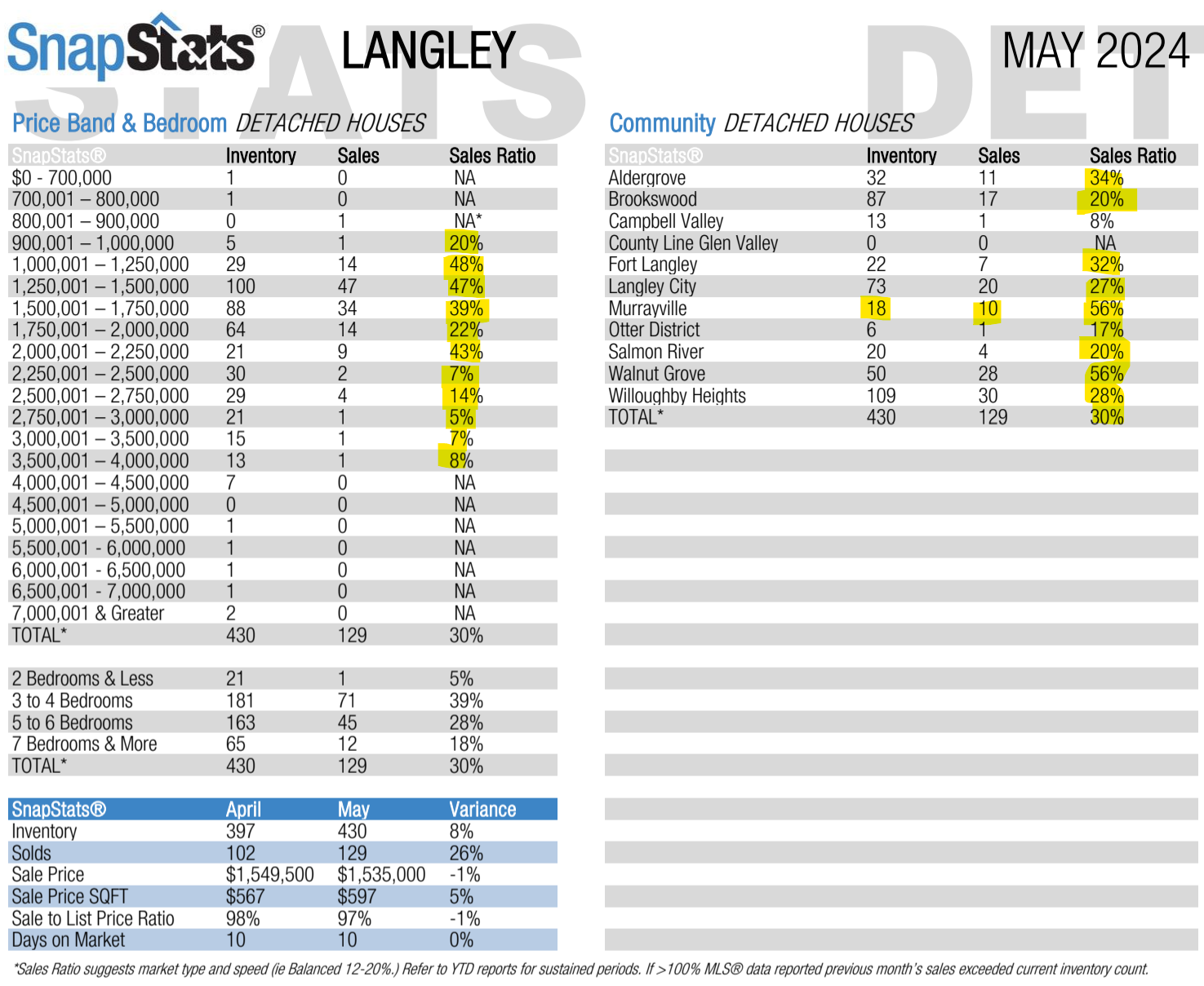

Langley Detached Houses:

What we saw in the month of May was nothing short of a mystery, and it’s actually still being worked out as we speak.

Simply put – there was an abnormal amount of sales reported in May AFTER the month was finished. (In some areas it was as many as 5% to 10% more sales, but in some areas like Walnut Grove it was 100% more sales!) This completely changed projections from the third week of May to now and you can bet I already contacted everyone within our Fraser Valley Board and they’ve already taken a proactive approach to problem solving this for the future while kindly taking my input so if the stats I show you below are NOT what you were expecting say after a conversation late last month it’s either due to reporting issues with sales OR a glitch with our stats so here we go with what are the broken down REAL numbers!

Due to the reporting issue mentioned above, these stats are not going to match my mid to end of month market updates because of that issue so these numbers are actually better than those reports.

Due to the reporting issue mentioned above, these stats are not going to match my mid to end of month market updates because of that issue so these numbers are actually better than those reports.

Detached Sales ratios are up slightly in most categories despite very low sales volume in the higher priced points.

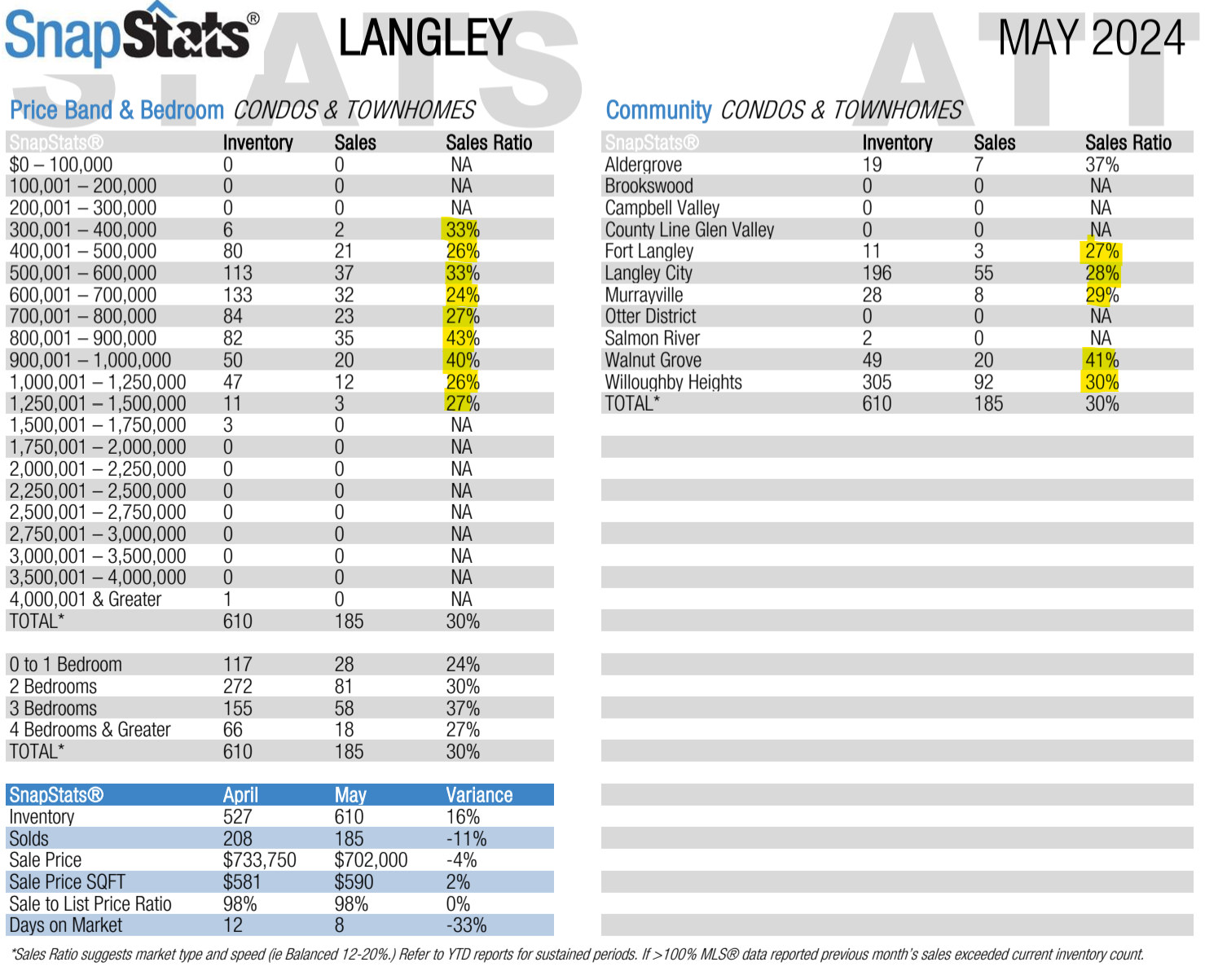

Langley Condos and Townhomes:

For Condos and Townhomes we actually see ratios ralling in nearly every price point and area. Some areas spiked 10% inventory in 3 weeks so that’s brought some ratios down however all of them are still fairly balanced other than the higher priced point homes in each category (not exactly shown here) tend to sit. (Moreso of a difference than just pure price). The “top’ of each class, if that analogy makes sense, are not selling very fast.

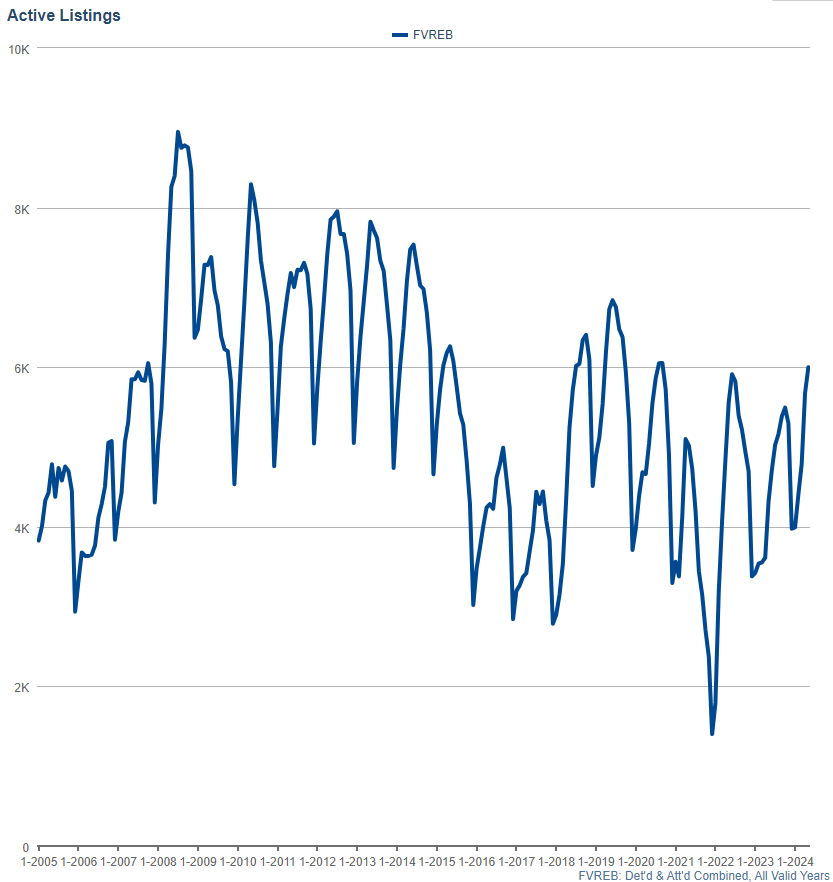

Finally, let’s take a look at the available Inventory!

Finally, let’s take a look at the available Inventory!

Active Listings:

Inventory has started to increase substantially! (specifically Detached and Attached Combined), with numbers rising from 5,670 in April 2024 to 5,999 in May, reflecting a 6% increase. This positions it as the 9th highest inventory May of the last 19 years on record, indicating a rather average level. (Back in January for comparison we also ranked as the 12th highest January on record). It’s challenging to discern significant trends from the modest uptick last month; however, this trend has been accelerating recently, with some areas that are heavy in rental properties experiencing very high inventory. I anticipate this trend will continue to happen as more and more sellers recognize the declining sales ratios, causing many to want to list ahead of what they see as a softer market ahead!

My Forecasting:

While the recent 0.25% cut in variable rates is likely to encourage more buyers who were previously undecided, I believe we will see an equal or greater influx of sellers who have been waiting for a more favorable market. This increase in inventory is likely to drive prices down. Discretionary properties that are rentals are experiencing such significant negative cash flow that they have become unaffordable.

For instance, just last week, I decided to list one of my rental properties in Clayton Heights for sale. Despite my desire to retain the property, the current interest rates result in a monthly loss of $3,000 to $3,500, making it impractical to keep it at this time.

1 & 2.) Interest Rates/Inflation:

As noted last month, the last inflation report saw inflation increase to 2.7% (from 2.9% in April, February and 2.9% in January respectively.) While this is down from December’s 3.4%) it appears we are quite stuck at this ~3% number for a number of reasons…I’m not so sure we’re going to see this come down soon necessarily, despite what many are hoping for. And if we assume the Bank of Canada won’t continue to lower interest rates until we are stable under 3%, then we are all hoping for this inflation to stay down. Also to consider though, if your child was getting straight F’s for as long as you can remember and they brought home a few C minuses would you say your work is over and fire the tutor and let the child go back to their naughty habits? I don’t think so! It’s the same here and the government with THEIR naughty spending habits that will continue to cause more inflation through debt and high interest rates on that debt.

In January, many top economists were still expecting 4-6 rate cuts for the year and expecting the first one to be between June and July…but this month, things have shifted! Many economists and those in the forward-hedging markets are now predicting as low as 1 to 2 rate cuts in 2024 (including the one we just had earlier this month) which is much less than many Canadians have been expecting and preparing for.

When you factor in that 47% of all mortgages will have been renewed at higher rates by the end of this year, and by next year we will have 65%, (with the rest in 2026!) we will have an uncertain but negative impact depending on how must of a difference the rates are between the record low rates during the COVID pandemic policies and when they renew! This is going to double some people’s mortgage payments and some homeowners simply won’t be able to manage without selling.

What about Fixed Rates? Fixed Rates are closely tied to the Canada 5-Year Bond Yield. This rate of return the Government of Canada gives on a 5-year bond is typically within 1% to 2% of the Fixed Interest Rates for various reasons. While early January predictions of the 5-Year Bond Yield seemed very positive, falling to a low of 3.38% on January 2nd, it has since risen to 3.717% (record-high for this year) with Economists far more bearish in this regard. Not great news for new mortgage takers or old mortgage holders hoping to renew soon with a lower interest rate than today’s highs.

3.) Rental Property Cash Flows

This section remains the same as last month, FYI: With interest rates as high as they are, and likely to remain higher for longer, rental properties have become dramatically different to own. Someone who purchased a home at 3% interest rates might have had the rent cover all the expenses of the house, referred to as “breaking even,” OR may have potentially had some positive cash flow if the home had a secondary suite or the like. The difference is NOW, that same rental property (at 5% to 7% interest) may be negative cash flowing anywhere from $500 to $4,000 a MONTH! This is becoming more and more untenable and will continue to lead to more rental properties having to be sold due to not being able to afford that much per month.

In BC, nearly a quarter of all homes are owned by investors. 1/3 of all condos are investor-owned. This is more than any other province, so this could have a major impact.

I’m personally quite persuaded by the rationale that the BoC is going to cut either one more time or zero more times until GDP slows down further than it is now. I still think the next cut could very likely be the July announcement dates, which could dramatically shift the market sentiment and likely increase prices. If interest rates remain unchanged for now, then we might see prices continue to increase slowly or very likely fall if we see large amounts of inventory finally hit the market for the reasons above. This could stagnate the market again in terms of sales too!

Also, If we start to see listings come to market faster than expected, this could drive prices lower again even despite an interest rate cut. It’s hard to know but it will very much be based on when interest rates start coming down and by how much!

YOU MADE IT!

I hope you found this helpful, and as always, please reach out if you’d like to chat about your own personal real estate situation and I’d love to help you out!

Cheers!

Until next time,