Hey Clients & Friends, 👋

Hope everyone had a great February – Lots to catch up on so buckle up 🤠😉!!!

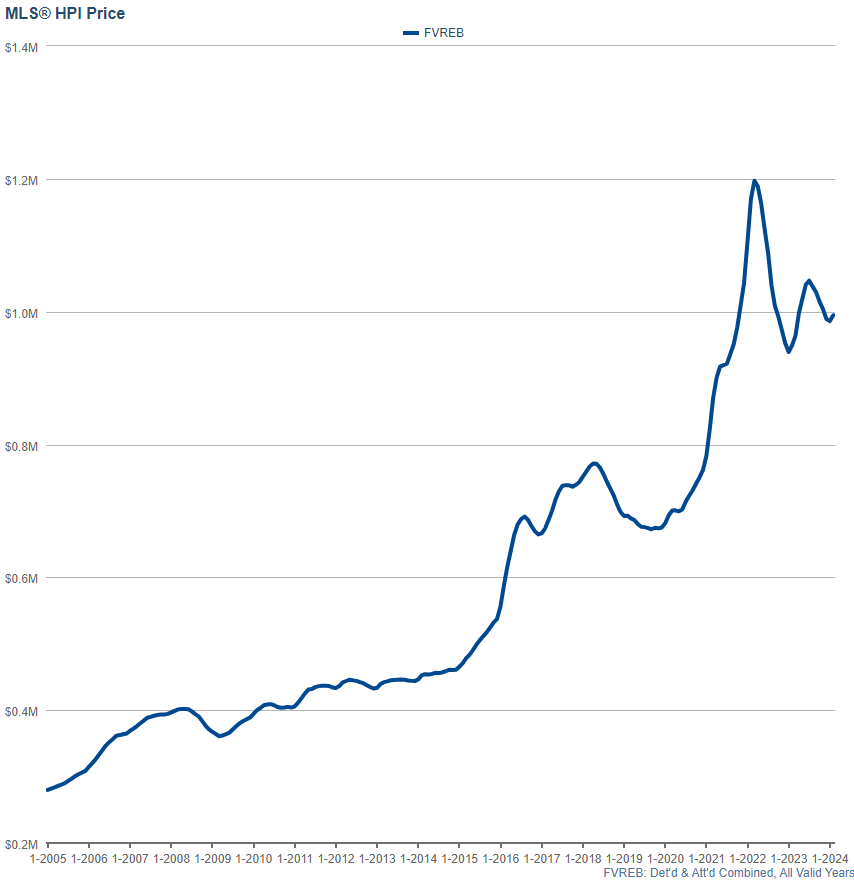

This February marks the first month that the Housing Price Index actually went UP in all categories after 7 straight months of price decline! Sellers reading this are already starting to smile, (and they should!) but hold on because there’s lots to unpack below still 😅. But first, some more news to report on Sales Volume: it went up as expected, and inventory went up, as expected, however what’s important is how this February stacks up to the last 20 Februarys! Stay tuned!

…So, let’s dive into the stats! 📊

Home Prices

In the Fraser Valley, we’re marking the 1st month of Housing Price Index increase, after 7 consecutive months of decline in home prices! While last month we saw condos slightly appreciate (0.3%) this month we saw all categories increase. For sellers this is signaling a potentially brighter outlook for prices compared to the recent trend but many buyers are worried they missed the bottom:

February 2024: +3.7% 🟢

January 2024 : -0.3% 🔴

December 2023 : -1.5% 🔴

November 2023: -1.1% 🔴

October 2023: -1.4% 🔴

September 2023: -0.9% 🔴

August 2023: -0.9% 🔴

July 2023: +0.5% (but started declining halfway through the month) 🔴➡️🔴

We’ll dive into just what and what kinds of homes are selling, keep following along!

Sales Volume & Sales Ratio:

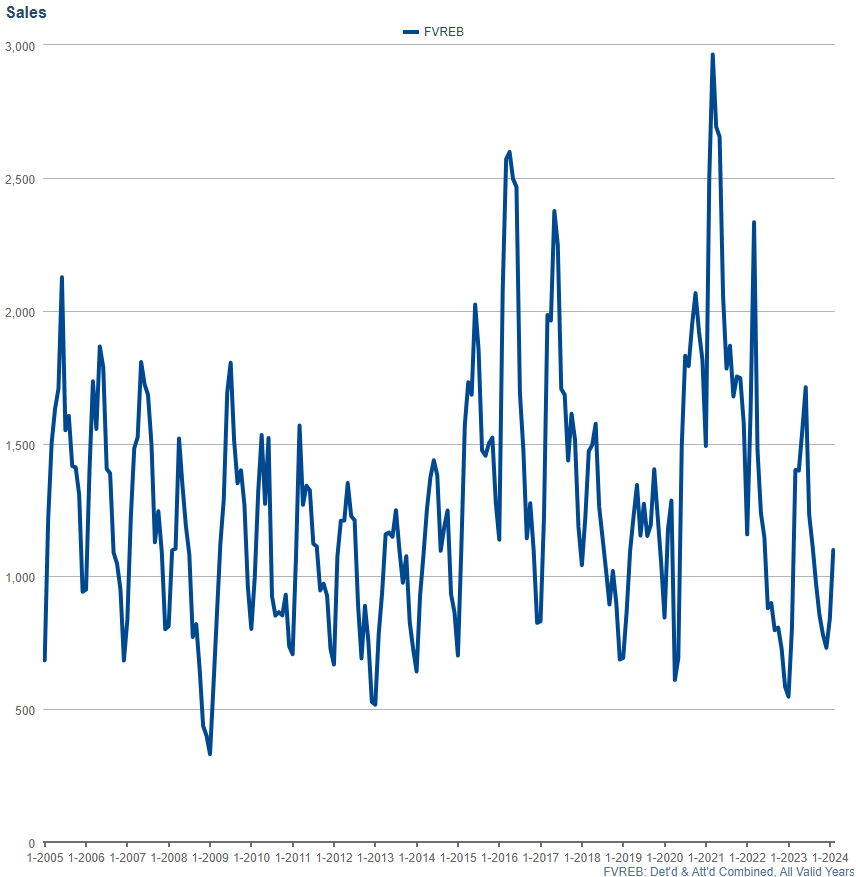

While February saw prices increase by a substantial 3.7% overall📈 , it also saw Sales Volume increase (Detached & Attached Combined) from 841 sales in January to 1,099 in February. 🚀 This marks a 36% INCREASE over February 2023 (803) but only ranks as the 11th fastest February out of the last 20….so very average when put in comparison! 🏎️ This is still encouraging news for those who were wondering when sales numbers would start to recover from the record-breaking lows of Fall 2022 to Winter 2024 🙏😅 but it’s hardly as impressive as a lot of media is making it out to be!

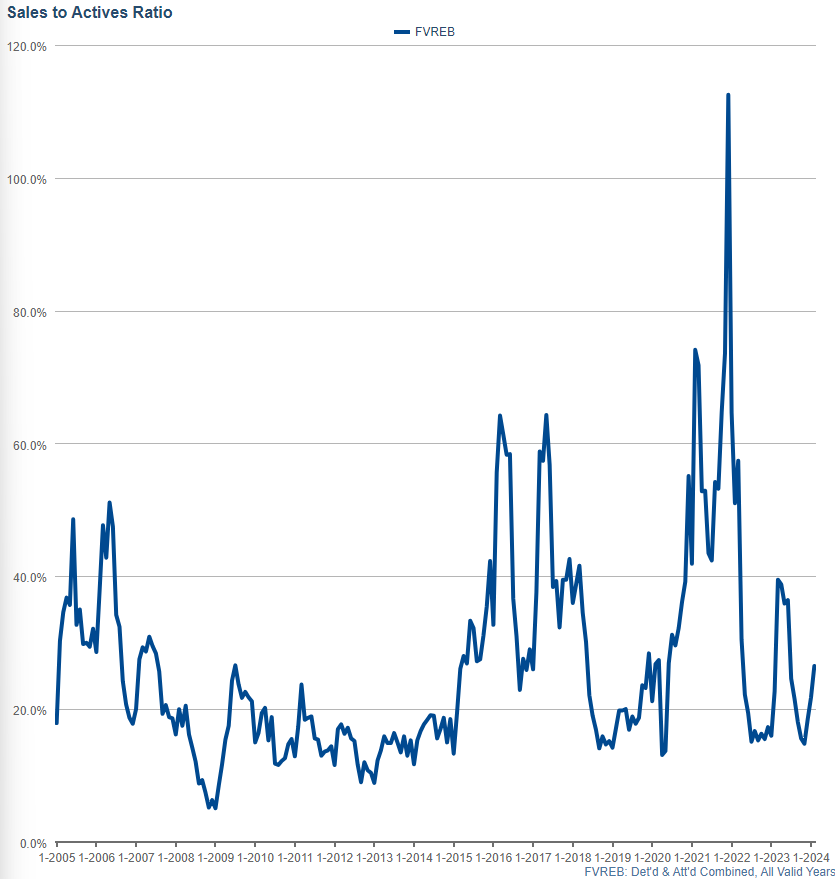

And then Sales Ratios 📊 (The number of listings that sell as a % of active listings in any given area) actually increased to an overall 26.5% from 21.8%. 📈 (which is very much heating up into a sellers market with many homes getting bid into multiple offers for the first time in almost a year.)

And then Sales Ratios 📊 (The number of listings that sell as a % of active listings in any given area) actually increased to an overall 26.5% from 21.8%. 📈 (which is very much heating up into a sellers market with many homes getting bid into multiple offers for the first time in almost a year.)

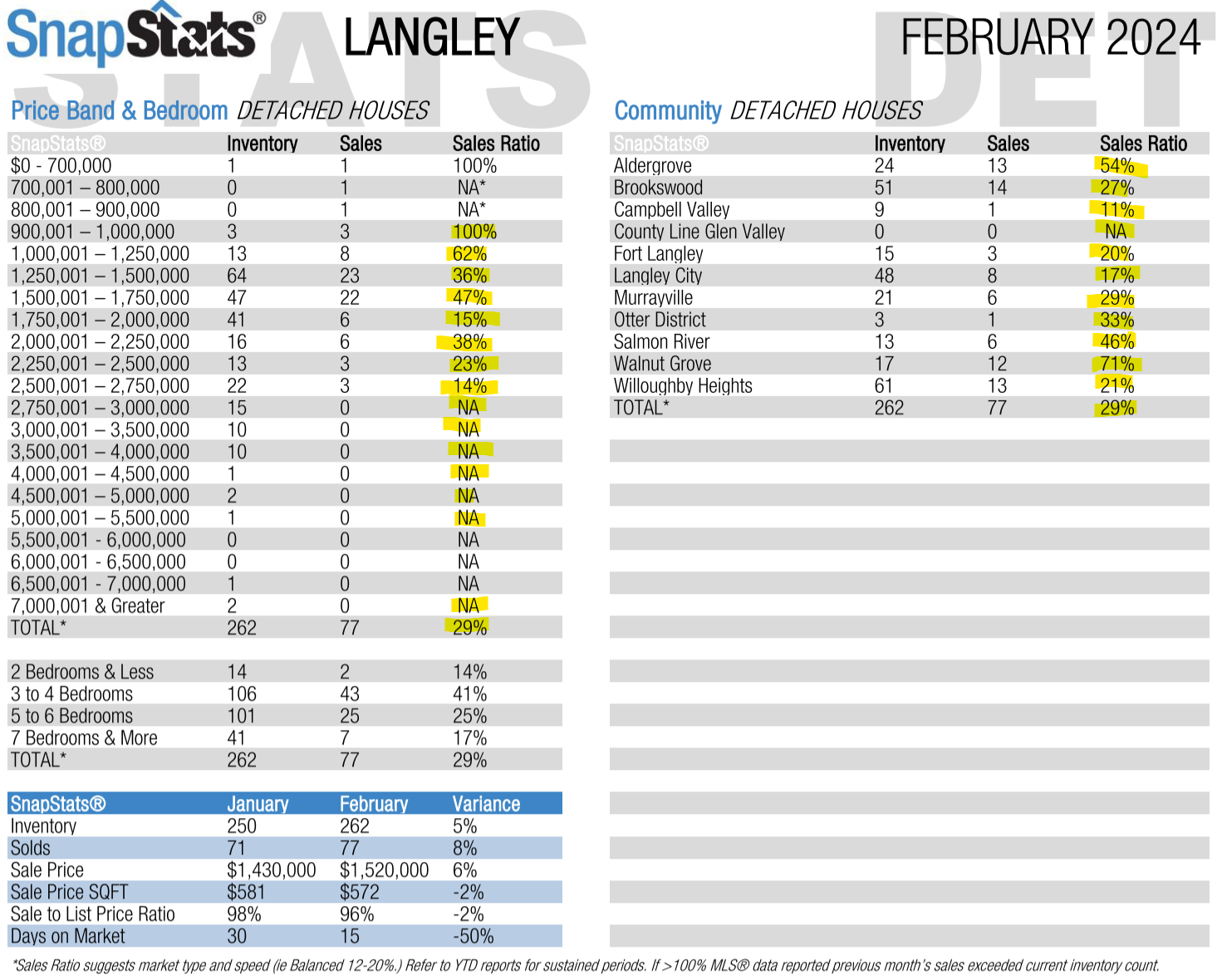

Just like last month, we’re going to have a look at a couple of areas in the Fraser Valley, starting off with Langley Detached houses: 🏡

Sales ratios have increased substantially in nearly every price/area category! 📈

Last month we still had very few homes sold in the higher price points, and while that’s still largely true, we’ve seen the $2M – $2.75M market open up with 12 sales in that price range (up from 7 last month! 💰)

This pushed the AVG PRICE up 6% because the higher price points finally unlocked and brought that average much higher! 🚀 Keep in mind this is not meaning prices themselves have gone up 10% but that just the average sale price moved up that much higher. This is really great news for anyone with a more expensive home who was looking to sell last year and couldn’t – now the conditions are starting to improve in most price points! 🏡✨

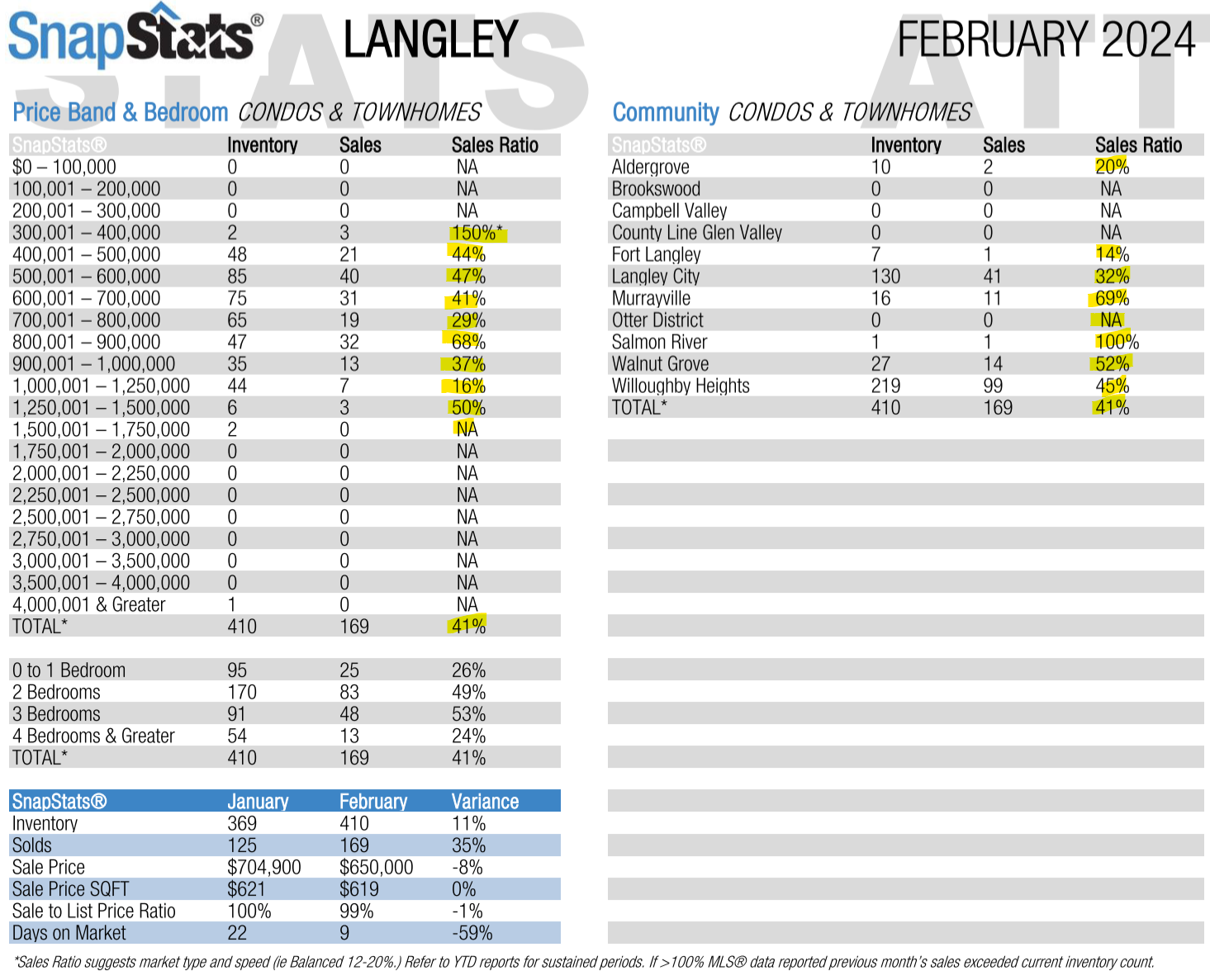

Even better news for Langley (And all Fraser Valley) Condo and Townhome owners! 🎉 Sales ratios have jumped up to highs that haven’t been seen since Spring 2023 (before the last two interest rate increases!)…and we’re still seeing that number seem to increase. Some price points have sales ratios as high as 68% and some areas of Langley are 69% sales ratio across all Condos / Townhomes! 📊 (Taking out low volume prices/areas).

Lastly, let’s have a look at Inventory out there!

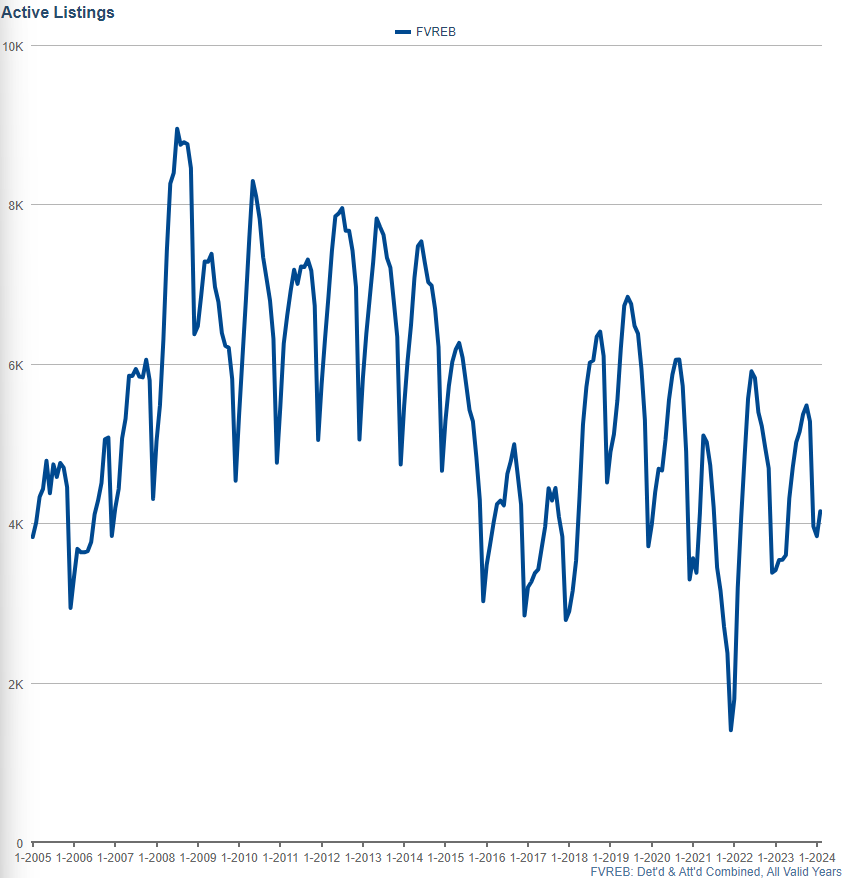

Active Listings: While we saw somewhat encouraging news in pricing, sales volume, and sales ratios, we saw a very slight increase in inventory (specifically Detached and Attached Combined), (3,837 in January to 4,149 in January, or a 11% decrease). This ranks as the 12th highest inventory month of the last 20 years on record, so again, very mediocre / average ! (January was also was the 12th highest January on record ) 📉 It’s hard to derive any big patterns from underwhelming increase last month; however, much of this was due to increased sales activity this month so this was to be expected. I think this will start to change quickly as more and more sellers realize the sales ratios are rapidly improving and it might be a much better time to consider selling! 💡🏡

My Forecasting:

I’ll do my best to keep it short (but we know I never do lol 😅).

1 & 2.) Interest Rates/Inflation:

While the last inflation report saw inflation fall to 2.9% from December’s 3.4%. I’m not so sure we’re going to see this trend necessarily continue, despite what many are hoping for. And if we assume the Bank of Canada won’t lower interest rates until we are stable under 3%, then there really isn’t any big reason to celebrate just yet. Think about it, if your child was getting straight F’s for as long as you can remember and they brought home one C minus would you say your work is over and fire the tutor and let the child go back to their naughty habits? I don’t think so! It’s the same here and the government with THEIR naughty spending habits that will continue to cause more inflation through debt and high interest rates on that debt.

In January, many top economists were still expecting 4-6 rate cuts for the year and expecting the first one to be between June and July…but this month, things have shifted! Many economists are now predicting as low as 2 to 3 rate cuts which is much less than many Canadians have been expecting and preparing for. 🔄

When you factor in that 47% of all mortgages will have been renewed at higher rates by the end of this year, and by next year we will have 65%, (with the rest in 2026!) we will have an uncertain but negative impact depending on how must of a difference the rates are between the record low rates during the COVID pandemic policies and when they renew! This is going to double some people’s mortgage payments and some homeowners simply won’t be able to manage without selling.

What about Fixed Rates? Fixed Rates are closely tied to the Canada 5-Year Bond Yield. This rate of return the Government of Canada gives on a 5-year bond is typically within 1% to 2% of the Fixed Interest Rates for various reasons. While early January predictions of the 5-Year Bond Yield seemed very positive, falling to a low of 3.38% on January 2nd, it has since risen to 3.52%, with Economists far more bearish in this regard. Not great news for new mortgage takers or old mortgage holders hoping to renew soon with a lower interest rate than today’s highs.

3.) Rental Property Cash Flows

This section remains the same as last month, FYI: With interest rates as high as they are, and likely to remain higher for longer, rental properties have become dramatically different to own. Someone who purchased a home at 3% interest rates might have had the rent cover all the expenses of the house, referred to as “breaking even,” OR may have potentially had some positive cash flow if the home had a secondary suite or the like. The difference is NOW, that same rental property (at 5% to 7% interest) may be negative cash flowing anywhere from $500 to $4,000 a MONTH! This is becoming more and more untenable and will continue to lead to more rental properties having to be sold due to not being able to afford that much per month. 💔

In BC, nearly a quarter of all homes are owned by investors. 1/3 of all condos are investor-owned. This is more than any other province, so this could have a major impact. 📉

I’m personally quite persuaded by the rationale that the BoC is going to wait until GDP slows down further than it is now, and also wait for inflation to stabilize closer to 3% before it starts to decrease rates. I still think it could very likely be around the June/July announcement dates, which would dramatically shift the market sentiment and very likely increase prices even more than they’ve just started to go up (if not with the first cut, then the second)! If interest rates remain unchanged for now, then we might see prices continue to increase until we see large amounts of inventory finally hit the market for the reasons above which might stagnate the market again in terms of sales too!

Also, If we start to see listings come to market faster than expected, this could drive prices lower again. It’s hard to know but it will very much be based on when interest rates start coming down and by how much!

I hope you found this helpful, and as always, please reach out if you’d like to chat about your own Personal Real Estate Situation, and I’d love to help you out! 🙌

And if you’re interested in how much YOUR Home is worth – Please Reach out today for a No Obligation Home Evaluation! 🏠

Cheers! 🥂