Here’s What You Need to Know.

We’re already a week into March, and while last month’s discussions revolved around speculation, we’ve now entered the reality phase of the Trump Tariffs—where policy has turned into action, and Canada is responding in kind.

Tariffs & Their Impact on Canadian Real Estate – What’s Changed?

Last month, Trump’s tariffs were still being talked about as a negotiation tactic—and to be fair, they still could be. But now, we’ve officially seen the first wave of tariffs take effect, along with Canada’s counter-tariffs and a series of major announcements from both sides of the border.

This has only deepened economic instability, which is already having a major impact on the market.

Here’s a breakdown of what’s changed since last month:

The New Reality: U.S. Tariffs & Canada’s Response

The biggest difference? It’s no longer just a threat—it’s happening.

What This Means for Real Estate Right Now

Will the Tariffs Stay or Will They Go?

Right now, there are three major schools of thought on what happens next:

Some believe this is temporary and will disappear once Canada makes certain trade & policy concessions.

Some believe this is temporary and will disappear once Canada makes certain trade & policy concessions.

Others believe tariffs are here to stay for the long haul and will have long-term consequences.

Others believe tariffs are here to stay for the long haul and will have long-term consequences.

Some blame Trump for the tariffs, while others argue Trudeau’s policies put Canada in a weak negotiating position to begin with.

Some blame Trump for the tariffs, while others argue Trudeau’s policies put Canada in a weak negotiating position to begin with.

Regardless of where you stand, the reality remains:

And that’s exactly what we’re seeing as we track market activity through February and early March.

If this whole thing gives you anxiety… same. Keep reading.

Check out my latest post on check out my latest post on Trudeau’s SECRET home equity TAX:

February Highlights

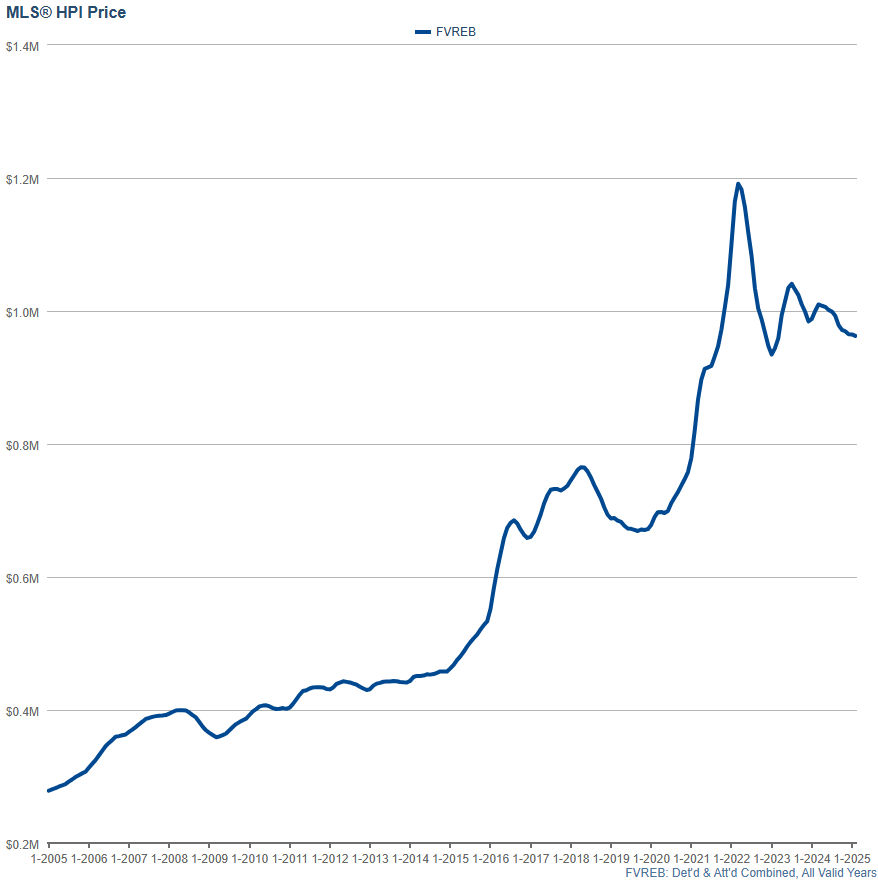

February marks the 11th consecutive month of decline in the Housing Price Index (HPI) for Detached and Attached properties, including Houses, Townhomes, Condos, Duplexes, and Row Homes in the Fraser Valley.

However, sales volume tells an interesting story—depending on how you look at it.

Meanwhile, HPI fell slightly from $964,800 to $962,500—a 0.24% drop.

Price Change Recap:

- February 2025: -0.24%

- January 2025: -0.02%

- December 2024: -0.46%

- November 2024: -0.23%

- October 2024: -0.7%

- September 2024: -1.4%

- August 2024: -0.7%

- July 2024: -0.3%

- June 2024: -0.5%

- May 2024: -1.0%

- April 2024: -0.2%

(revised from +0.5%)

(revised from +0.5%) - March 2024: +1.4%

- February 2024: +0.9%

(previously recorded incorrectly as +3.7%)

(previously recorded incorrectly as +3.7%) - January 2024: -0.3%

- December 2023: -1.5%

- November 2023: -1.1%

- October 2023: -1.4%

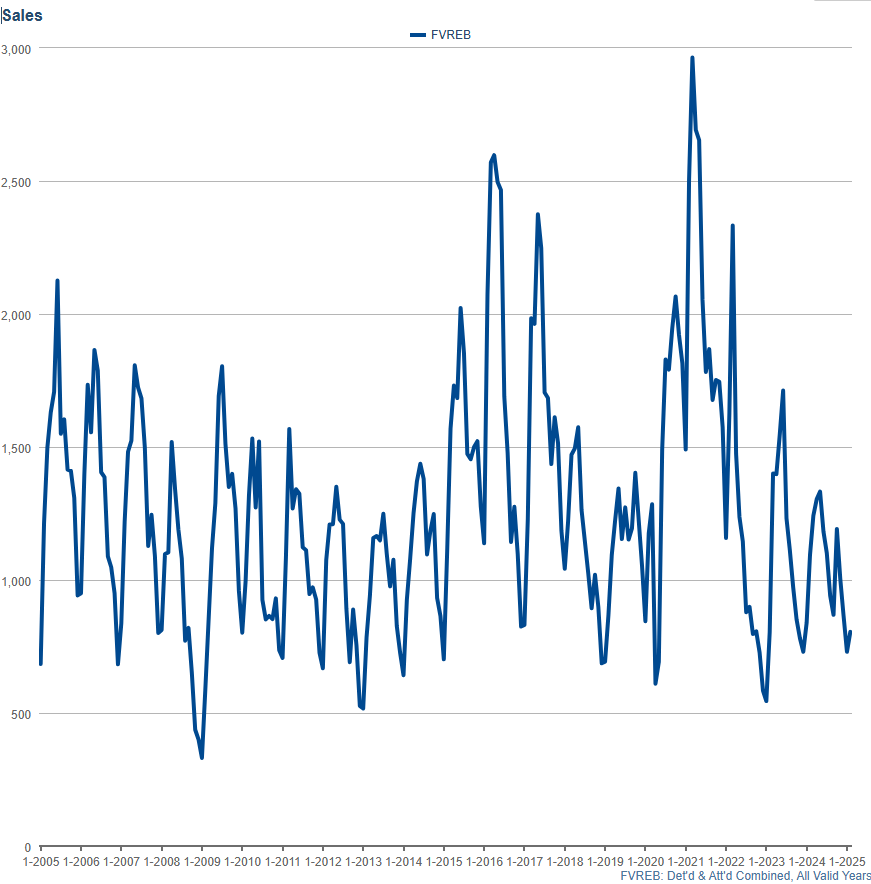

Sales Volume

While February is typically much busier than January, this year’s increase was minimal, with sales rising just 10.27% month-over-month from 730 in January to 805 in February—a small bump, but still well below historical norms.

To put things in perspective:

That’s not just a seasonal slowdown—that’s an increasing trend of uncertainty.

While this isn’t necessarily a sign of an outright crash, buyers are pulling back, and sellers are facing tougher conditions than they have in years. The market remains hesitant, and we’ll continue tracking these trends in the months ahead.

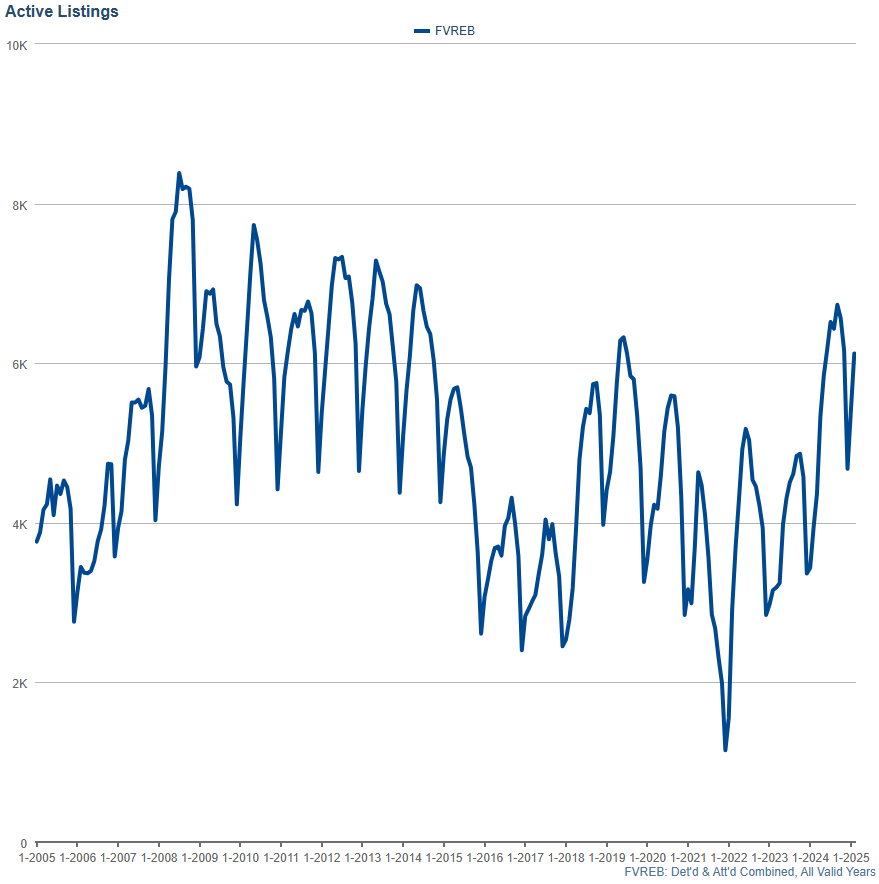

Active Listings

With one of the slowest Februarys on record, it’s no surprise that inventory is surging, but here’s the real kicker:

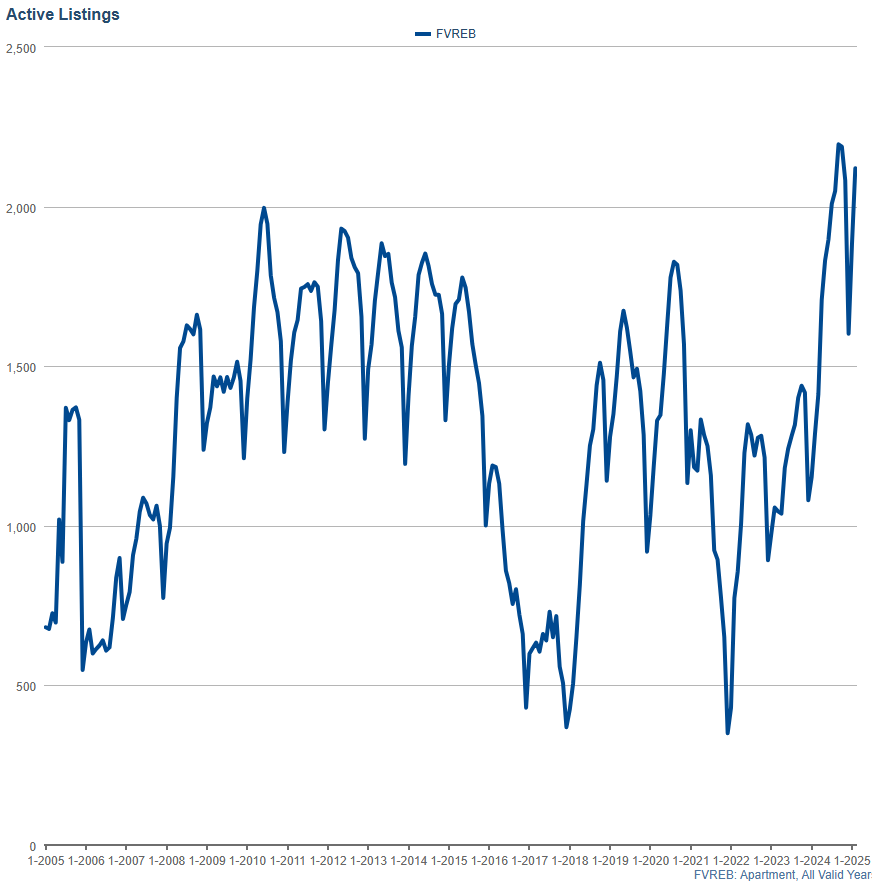

Condo Market – Inventory Surge Continues

For context, last month was already the 7th highest January for condo inventory.

Now, we’ve seen a sharp spike again in February—confirming a troubling trend for sellers.

Why Is Condo Inventory Surging?

A large portion of these units were bought by investors who planned to rent them out for profit. But now, they’re stuck because:

This creates a perfect storm where many investors can’t afford to sell at market value, but they also can’t sustain the financial losses much longer.

Unless interest rates drop significantly or valuations stabilize, this imbalance is likely to continue.

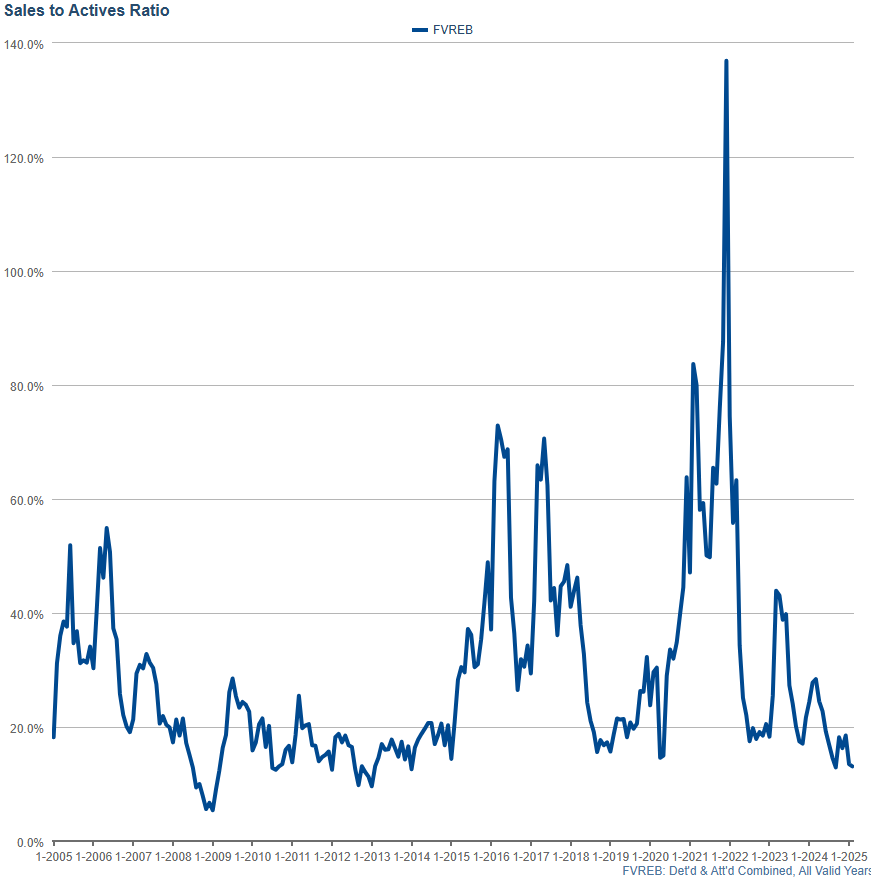

Sales Ratios

Sales ratios—a key measure of market activity—declined even further in February, reflecting continued softening demand across most property types.

What This Means for the Market

Sales ratios provide one of the clearest real-time indicators of market sentiment. With numbers like this, it’s clear that uncertainty is weighing heavily on buyers—and sellers need to be strategic in this shifting market.

The Bank of Canada’s rate announcement on Wednesday, March 12, 2025 has now come and gone, and it’s already shaping up to be a pivotal moment for the real estate market.

The Bank of Canada cut its key policy rate by 0.25%, bringing the overnight rate to 2.75%, which is at the midpoint of the neutral range. This move was widely anticipated and directly impacts variable-rate mortgages, home equity lines of credit (HELOCs), and other loans.

But that’s not all—bond yields have been falling as Canadians flock to bonds for security, pushing fixed mortgage rates to their lowest levels this year.

Could Interest Rate Cuts Stop Prices from Falling?

So, What’s MY Outlook?

Do I think interest rate cuts will suddenly reverse the market? No.

Do I think they will stop prices from free-falling? Probably.

Do I think we could start seeing stabilization and even some appreciation? Yes—but it will take time.

I hope you found this forecast helpful!  As always, feel free to reach out if you’d like to discuss your personal real estate situation

As always, feel free to reach out if you’d like to discuss your personal real estate situation  . I’m here to help! And if you’re curious about how much YOUR home is worth, contact me today for a no-obligation home evaluation!

. I’m here to help! And if you’re curious about how much YOUR home is worth, contact me today for a no-obligation home evaluation!

Faces Escalating Trade Tensions Amid New U.S. Tariffs

Faces Escalating Trade Tensions Amid New U.S. Tariffs