Hey Everyone,

I hope you all had an awesome July! There’s a lot to break down, so let’s jump right in!

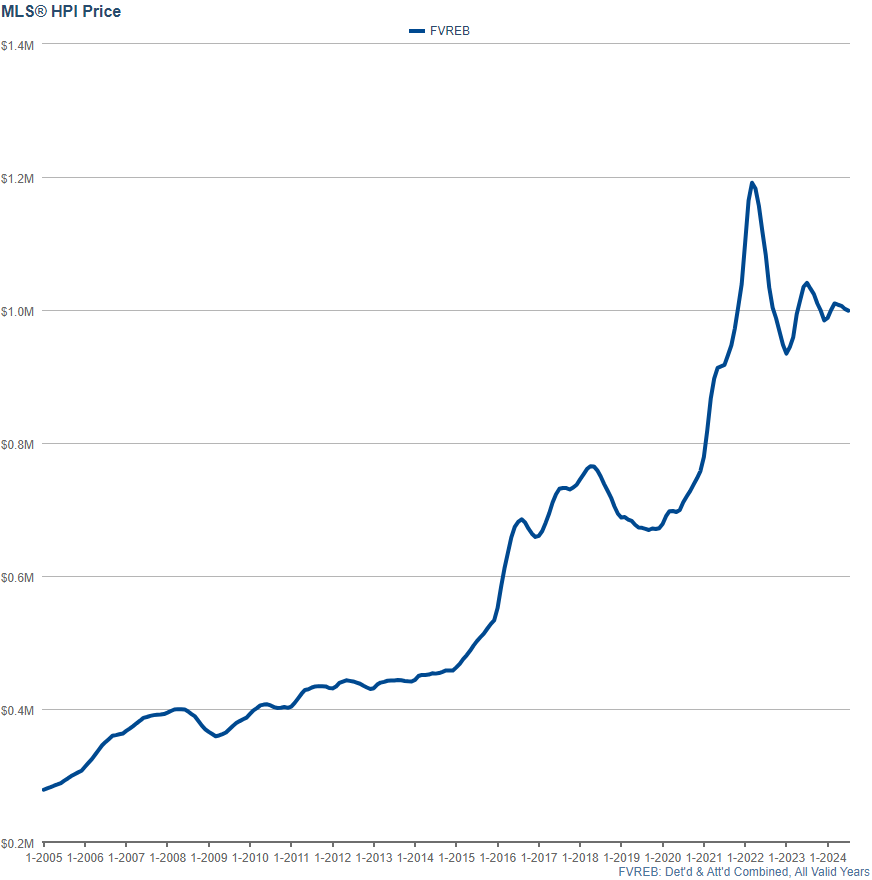

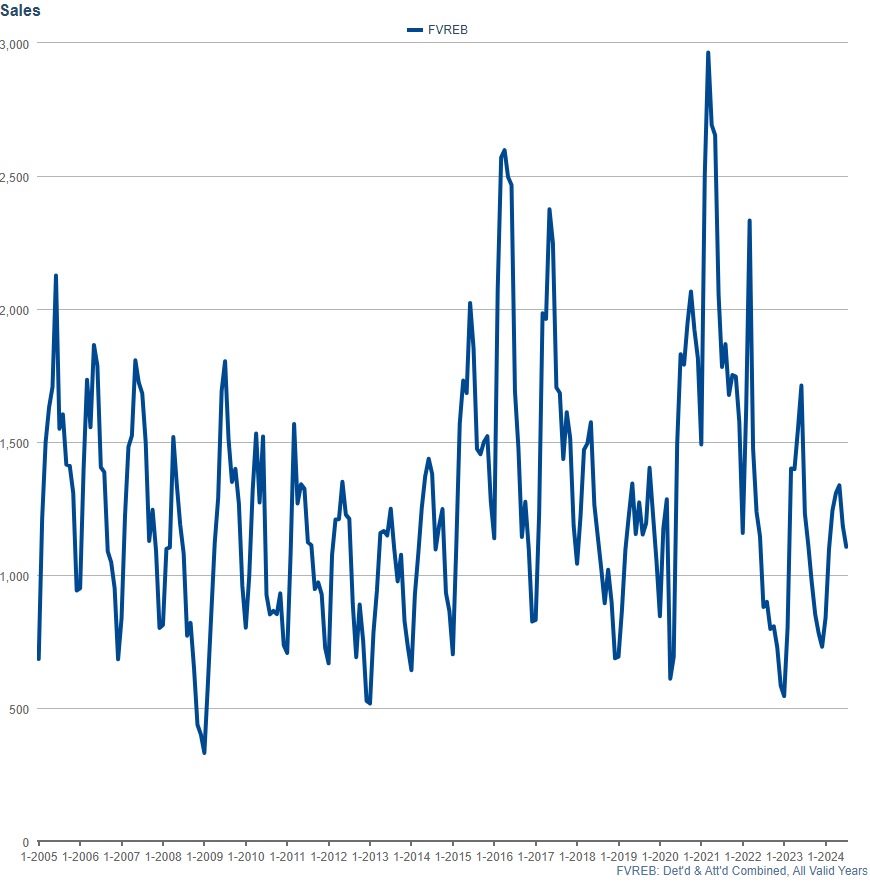

July marks the third consecutive month where the Housing Price Index (HPI) for Detached & Attached properties (including Houses, Townhomes, Condos, Duplexes, and Rows) in the Fraser Valley has dropped, following three months of price gains. This was another tough month for sellers, with one of the lowest sales volumes for any July in nearly two decades of recorded history. But there’s plenty more to discuss below!

To start, sales volume dipped again from June to July (from 1,184 to 1,106, a -7% decline), which was disappointing for many sellers who had hoped the second consecutive 0.25% Interest Rate cut would lead to more buyer activity. Instead, we saw an increase in the number of sellers, as you’ll see in the details below. This trend wasn’t what most people expected, especially following a near record-low June. For those who have been keeping up with my updates, you might remember this as one of my earlier predictions that has, unfortunately, come true.

What’s crucial now is how this July measures up against the last 20 Julys. Stay tuned!

Let’s dive into the numbers!

Home Prices

In the Fraser Valley, we’re now seeing the third month of decline in the Housing Price Index, covering all property types (Detached, Townhomes, and Condos), following three months of rising prices. For sellers, this continues to be a concern as many were hoping that the interest rate cuts would sustain the upward trend in prices. However, it’s worth noting that despite interest rates being a major factor, prices have dropped in about 80% of the past 19 years between June and July—not necessarily a direct cause, but it’s an interesting point I discovered through deeper analysis.

July 2024: -0.3%

June 2024: -0.5%

May 2024: -1.0%

April 2024: +0.5%

March 2024: +1.4%

February 2024: +0.9%

January 2024: -0.3%

December 2023: -1.5%

November 2023: -1.1%

October 2023: -1.4%

September 2023: -0.9%

August 2023: -0.9%

Sales Volume & Sales Ratio

While July experienced a slight dip in prices overall

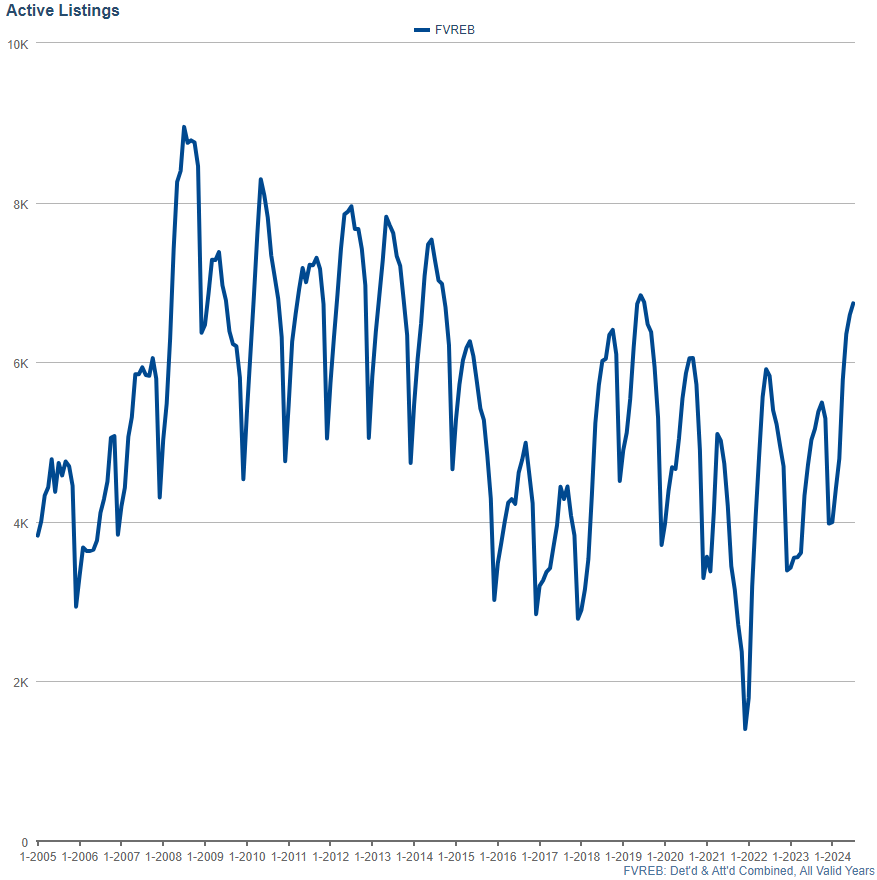

Active Listings

Inventory has been on the rise!

While it’s tough to pinpoint significant trends from the modest increase over the last three months, there has been a noticeable acceleration recently, particularly in areas with high rental property inventory. I anticipate this trend will continue as more sellers become aware of the declining sales ratios and decide to list their properties in anticipation of what they perceive as an uncertain market ahead.

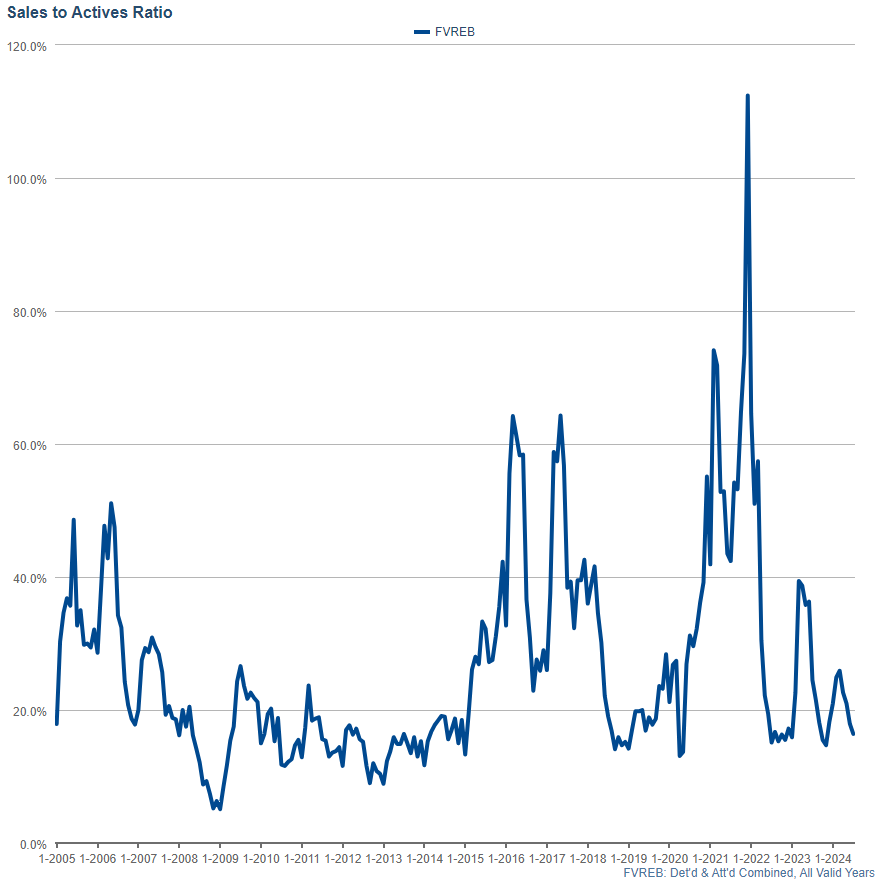

Sales Ratios

Sales Ratios (the percentage of active listings that sell in any given area) dropped once more, down to 16.4% from 17.9%.

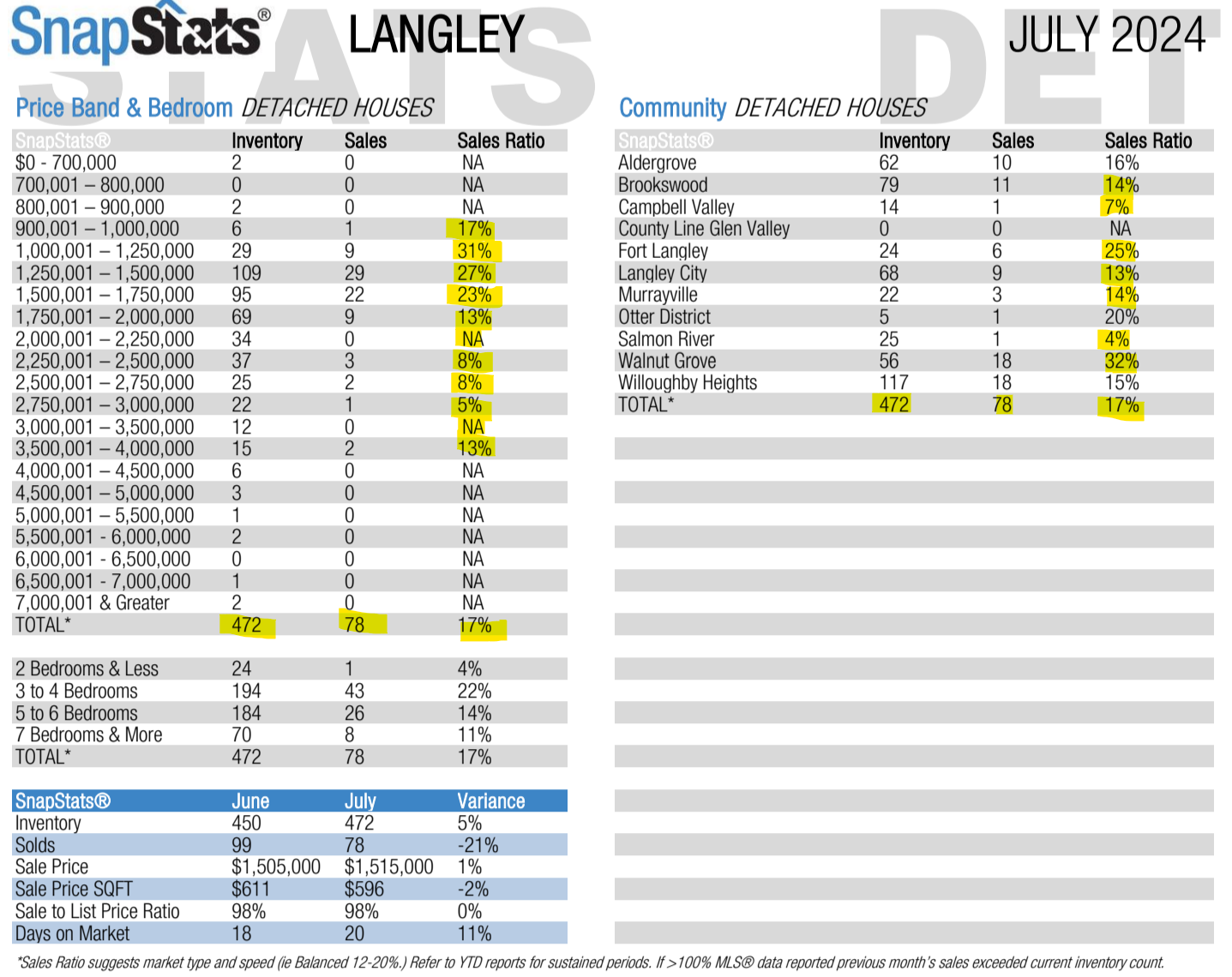

Langley Detached Houses

Just like last month, we’re going to look at a couple of areas in the Fraser Valley, starting with Langley detached houses:

In July, we saw a continuation of trends at an accelerating pace. More listings and fewer sales resulted in lower ratios everywhere, and the higher up in price you go, the worse the story is.

Condos and Townhomes

For condos and townhomes, the story is a bit more positive, with many areas holding steady or even showing slight improvements compared to the previous month. The situation hasn’t been as challenging as it has been for detached homes or acreages. In fact, sales ratios in Langley saw a 1% increase from June to July.

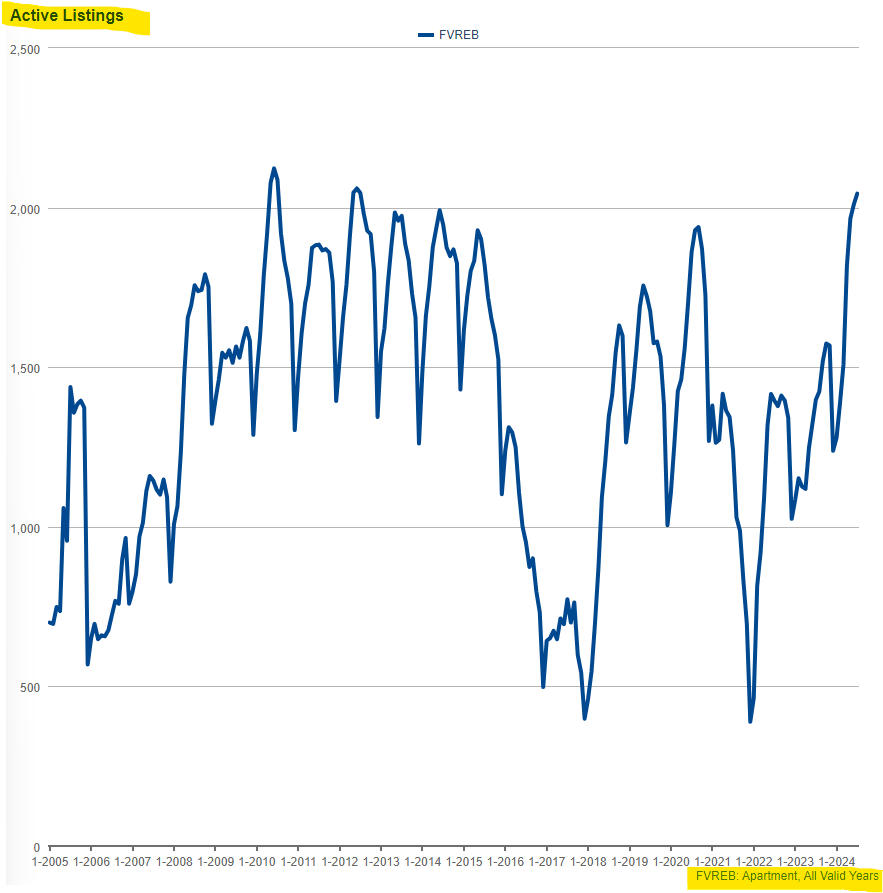

However, when we broaden our view to the entire Fraser Valley, the picture changes, as condo inventory has reached the 3rd highest level in 19 years! This highlights that, while condos and townhomes are currently outperforming detached homes, the overall market still faces challenges.

My Forecasting

My Forecasting

Here’s my quick (well, maybe not so quick lol) outlook.

The two consecutive 0.25% cuts on variable rates might have encouraged more buyers to consider entering the market, but as we saw in June, an even larger number of sellers decided to list their properties. This surge in inventory, especially within the condo market, is likely to continue putting downward pressure on prices.

Rental properties are becoming so cash-flow negative that they’re simply unaffordable. On June 6th, the day of the rate reduction, I listed one of my rental properties in Clayton Heights. Unfortunately, I was losing $3,000 to $3,500 a month due to the current high interest rates. As much as I wanted to keep it, the numbers just didn’t add up! It was a bittersweet moment since I had lived in that home for 8 years myself, but sometimes you have to make tough decisions.

The rate cuts in June and July have brought more sellers into the market than buyers, and the rental market is punishing landlords with these high rates, resulting in significant negative cash flows. As mentioned earlier, I had to sell one of my rentals because of this. With more rental properties hitting the market and prices continuing to fall, it seems things might get worse before they get better. The new tenancy laws are also making it even tougher for landlords to hold onto their properties.

I hope you found this forecast helpful! As always, feel free to reach out if you’d like to discuss your personal real estate situation. I’m here to help!

And if you’re curious about how much YOUR home is worth, contact me today for a no-obligation home evaluation!